12.12.2023 08:59 AM

12.12.2023 08:59 AMPound did not show significant movement despite the fluctuations. Euro remained stagnant as well, largely due to an empty macroeconomic calendar. However, both will not stay sluggish for long as ahead lies the unemployment rate report in the UK, which forecasts say will rise from 4.2% to 4.3%. Markets also await the data on US consumer prices, which will likely slow down from 3.2% to 3.1%. This easing of inflation will convince the Fed to consider a softer monetary policy, which will provoke a weakening of dollar demand.

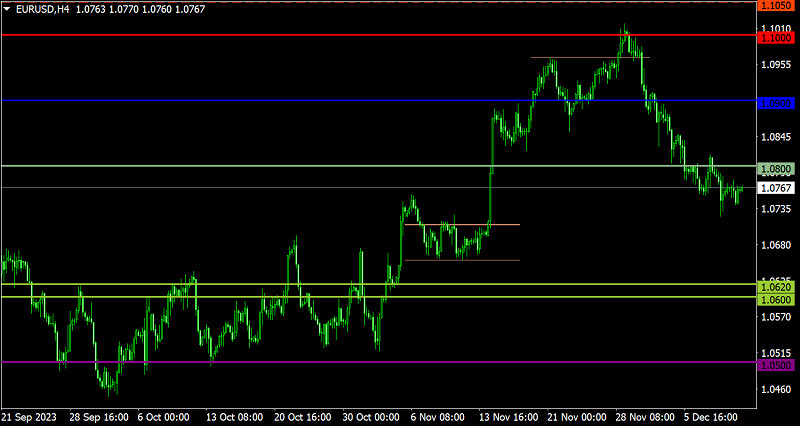

EUR/USD slowed its decline around 1.0750. Although no clear signal of the end of the correction could be seen, the volume of short positions will increase as long as the price stabilizes below 1.0750. But if the pair does not consolidate below 1.0750, there will be a rise towards 1.0800.

GBP/USD hit 1.2500, around which the volume of long positions increased. For the pair to rise further, traders need to keep the price above 1.2600. Otherwise, it will fall at a range of 1.2500/1.2600.