10.03.2025 10:35 AM

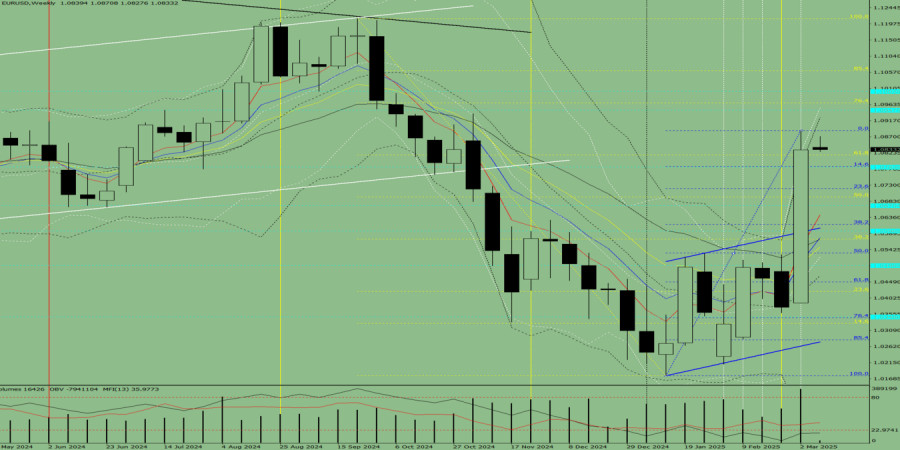

10.03.2025 10:35 AM趨勢分析(圖1):本週市場可能會從1.0833(上週收盤價)初步下行至1.0784,此為14.6%的回調位(藍色虛線)。在測試此水平之後,價格可能會重新上行,目標為1.0948,這是一個歷史阻力位(淺藍色虛線)。

綜合分析:

結論:整體市場前景看漲。

EUR/USD 預測本週K線形態:

預計這對貨幣組合在本週將保持上漲趨勢,週一形成帶有下影線的白色周K線(下跌走勢),週五形成上影線(下跌回撤)。

替代情景:

如果該貨幣對從 1.0833(上週收盤價)下跌,可能達到 1.0721(23.6% 回撤位,藍色虛線)。測試此水平後,價格可能恢復上行趨勢,向上達到 1.0888,對應於上方的分形點(藍色虛線)。