See also

25.07.2022 07:31 AM

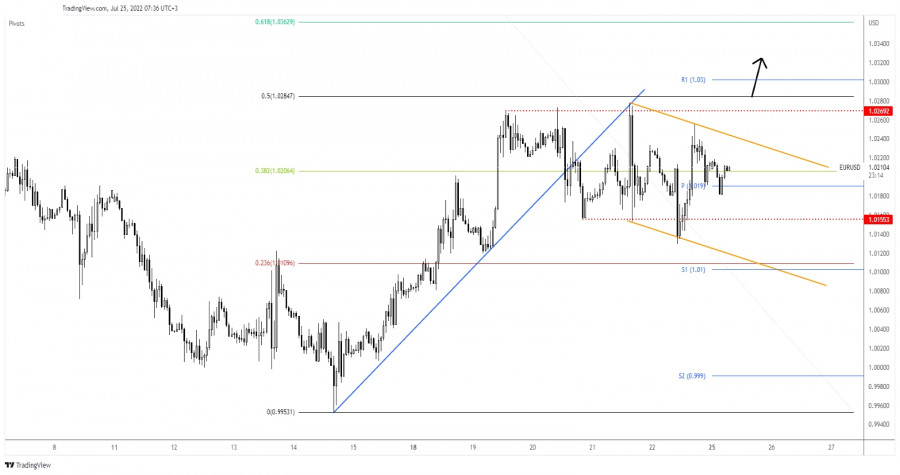

25.07.2022 07:31 AMThe EUR/USD pair continues to move sideways in the short term. It was trading at 1.0210 at the time of writing and its trajectory seems undecided. The Dollar Index moves somehow sideways, that's why the EUR/USD pair is trapped within a range.

Fundamentally, the German and Eurozone manufacturing and services data came in worse than expected on Friday. On the other hand, the US Flash Services PMI dropped from 52.7 to 47.0 points signaling contraction, while the Flash Manufacturing PMI came in at 52.3 points above 52.0 expected.

Today, the German Ifo Business Climate is expected at 90.0 points versus 92.3 points in the previous reporting period. Tomorrow, the CB Consumer Confidence could be decisive. The indicator could drop to 96.8 points from 98.7.

From the technical point of view, the EUR/USD pair is trapped between 1.0155 and 1.0269 levels. Now, it could develop a potential channel. Escaping from these patterns could bring new opportunities.

In the short term, it could challenge the weekly pivot point of 1.0190. The bias remains bearish, so personally, I will look for shorts as long as it stays under the 1.0268 key resistance.

A new higher high, a valid breakout through the 1.0269 could activate larger growth and could bring long opportunities.

On the other hand, a new lower low may activate more declines. The 1.0000 psychological level stands as a potential downside target.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.