See also

27.07.2022 03:23 PM

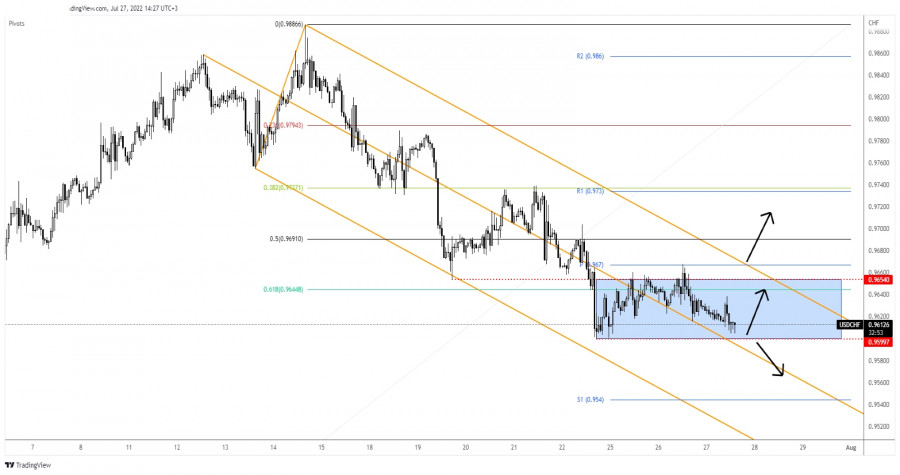

27.07.2022 03:23 PMThe USD/CHF pair is moving sideways in the short term, that's why we need to wait for the price to escape from this pattern before taking action. It was trading at 0.9623 at the time of writing. The pair has changed little lately and most likely the traders are expecting the FOMC decision before taking action. A 75bps rate hike is expected today. The Federal Funds Rate could be increased from 1.75% to 2.50%. The volatility could be huge around this event.

Technically, the USD/CHF pair was in a corrective phase in the short term but the price signaled that the sellers are exhausted and that the pair could try to develop a new leg higher. Fundamentally, the US data came in mixed today. Durable Goods Orders rose by 1.9% versus a 0.5% drop expected, Core Durable Goods Orders surged by 0.3% compared to 0.2% growth estimated, while the Goods Trade Balance Came in better than expected as well. Unfortunately for the USD, the Prelim Wholesale Inventories came in worse than expected. Later, the Pending Home Sales could bring more action.

In the short term, the USD/CHF pair is trapped between 0.9654 and 0.9599 levels. Jumping and the median line of the descending pitchfork, testing and retesting it signaled that the downside movement could be over.

Still, it's premature to talk about a new leg higher. The fundamentals will drive the rate today, so anything could happen. The bias remains bearish as long as it stays under the pitchfork's upper median line and below the weekly pivot point of (0.9670).

False breakdowns below 0.9599 could signal a new bullish momentum at least towards 0.9654 and up to the pitchfork's upper median line. A valid breakout above the upper median line (uml) and above the weekly pivot point of 0.9670 could activate a new swing higher and could bring new long signals, and setups.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.