See also

18.10.2021 11:02 AM

18.10.2021 11:02 AMLast week, the Japanese yen became one of the major currencies that showed a decline against the US dollar. At the same time, it should be noted that the dollar/yen currency pair showed rather impressive growth. Perhaps this is caused by the aggravated epidemiological situation in the world, where the fourth wave of COVID-19 is rampant. It is unknown how many more waves of this hated and annoying pandemic will be. However, during the exacerbation of COVID-19, it was the US dollar that investors preferred and still prefer as a protective asset. This factor likely caused the growth of the USD/JPY pair. However, since this review is devoted to the technical component, we proceed to analyze price charts, and let's start with a weekly scale.

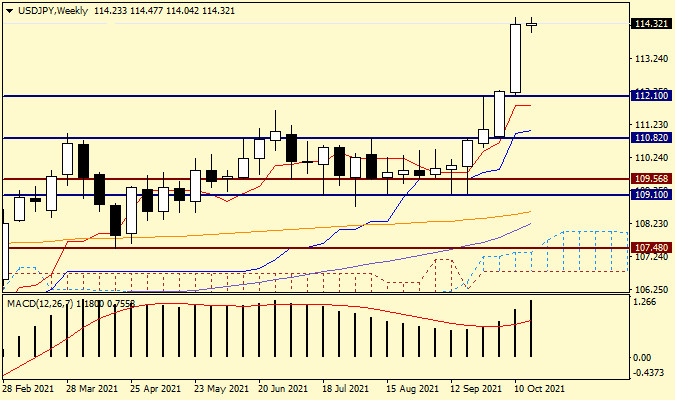

Weekly

As a result of the impressive growth shown at the auction on October 11-15, a large bullish candle appeared on the weekly chart with a closing price of 114.26. Thus, the hated resistance of sellers in the area of 112.00-112.25 was more than confidently broken through. However, one should not discount another interesting and quite strong mark of 113.00. We may see a pullback to this significant level during the trading of the current five-day period. If this happens, then there will be a good option for buying a pair. However, it is incorrect to determine the points for entering the market using a weekly timeframe. In the absence of the expected pullback and continuation of the rise from current prices, another landmark psychological level of 115.00 looms on the horizon of buyers. The task of bears in the current situation looks extremely difficult. To take control of the pair, they will need to absorb the hefty last white candle and close the weekly trading below the level of 112.00. In my opinion, such a task is almost impossible, although, as we know, everything happens on the market and nothing is particularly surprising.

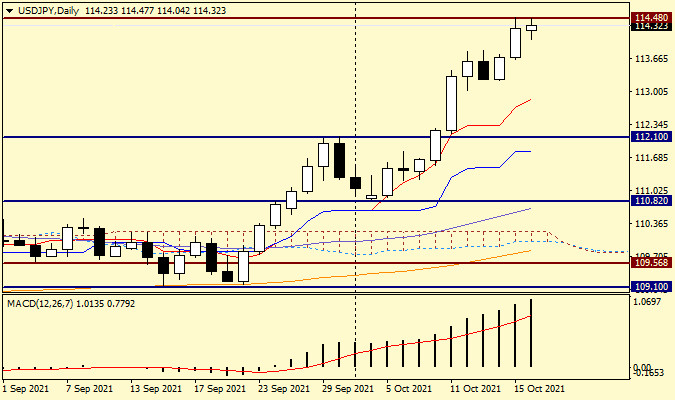

Daily

On this chart, all technical indicators turn up following the price, which can be characterized as support for growth and with a high probability of its continuation. The closest to the price (at 112.86) is the red Tenkan line of the Ichimoku indicator, so a pullback to Tenkan could be used to open long positions. However, given that the pair is currently trading near 114.28, such a deep pullback can be perceived as a change of course. As a more acceptable option for purchases, you can use a breakdown of the resistance of 114.48, fixing above this level and rolling back to it, after which you can try opening long positions. I am sure that this week we will return to the consideration of this currency pair. However, for now, I will outline the overall priority, which of course, comes down to purchases. Support levels: 114.00,113.40, and 113.00. Resistance passes at 114.60, 115.00, and 115.40. The general recommendation - we are looking for options to open purchases after corrective pullbacks, possibly to the designated support levels.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.