See also

22.12.2021 11:59 AM

22.12.2021 11:59 AMHi, dear traders!

Today's release of UK GDP data for the third quarter turned out to be mixed. The UK economy grew by 1.1% quarter-over-quarter, falling short of the expected 1.3%. However, the GDP increased by 6.8% year-on-year. Economists forecasted an increase of 6.6%. Taking into account the COVID-19 situation and the spread of Omicron, the data could not be considered weak. Despite the daily number of confirmed cases approaching 90,000, UK prime minister Boris Johnson is hesitant to enact another lockdown. Later today, US GDP growth report for the third quarter will be released, as well as the CB Consumer Confidence index data.

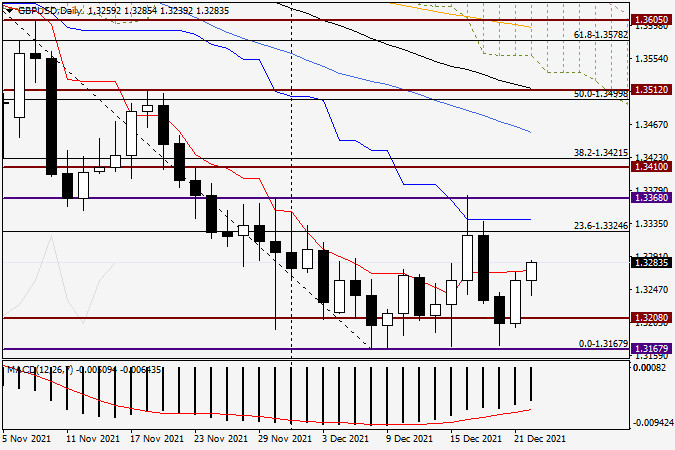

Daily

According to the daily chart, GBP went up against the US dollar during yesterday's session, closing at 1.3259. Today, bullish traders are pushing the pair up, and are currently breaking through the red Tenkan-Sen line of the Ichimoku cloud. If GBP/USD closes above the Tenkan-Sen line, it could rise into the 1.3325-1.3340 range, where it would encounter the 23.6% Fibonacci retracement level from 1.3832-1.3169, as well as the blue Kijun-Sen line of the Ichimoku cloud. If bearish reversal candlestick pattern appear in this range or below the resistance at 1.3368, short positions could be opened.

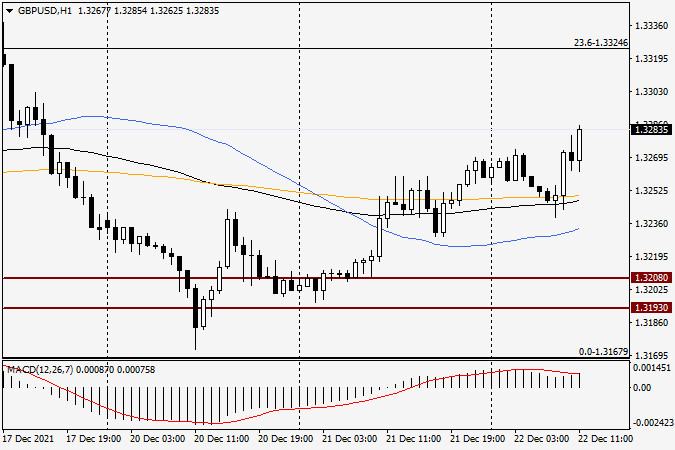

H1

According to the H1 chart, GBP/USD found strong support near the orange 200-day EMA line and is on the upside. At the time of writing this article, the pair could not surpass 1.3280. The pair's movement in the 1.3275-1.3300 area is important - if bearish signals appear, traders could open short positions. Long positions could be opened if GBP/USD descends towards 1.3250, where the 200-day EMA and 89-day EMA lines lie. Setting high targets is not recommended - a profit of 40 pips would be enough in these unsteady market conditions.

Good luck!

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.