See also

05.01.2022 11:00 AM

05.01.2022 11:00 AMBreaking news from the world of cryptocurrencies:

Last month, the digital asset market plunged into a correction phase. This happened after Bitcoin's price collapsed by more than 20% per day at the beginning of the month. Markets tend to rally ahead of the New Year as companies spend the remaining funds in their accounts and citizens are actively shopping ahead of the lengthy holidays. But this year, investors and companies are cautious about hoarding funds, due to expectations of a correction in the markets ahead of the rise in rates from the Fed and the ECB. In the United States and Europe, Christmas is considered the main holiday, so there are no long days off in the States and European countries. Therefore, the liquidity in the markets will remain at a normal level.

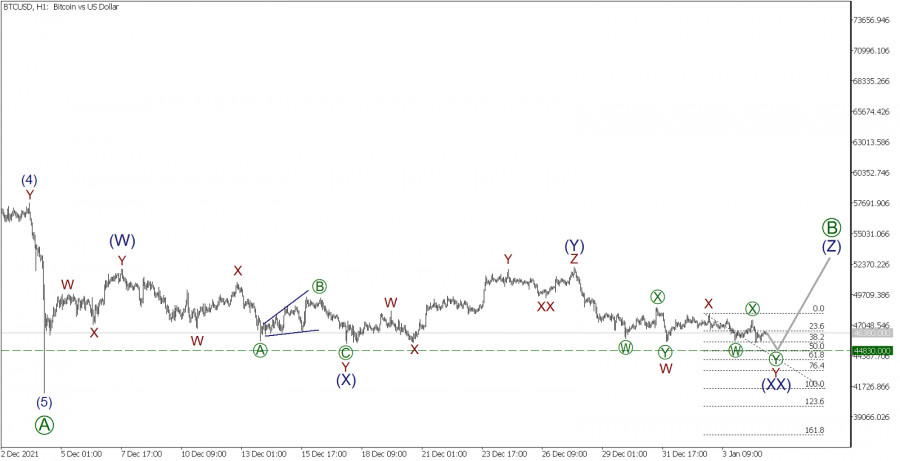

Now, let's continue to consider Bitcoin from the viewpoint of the Elliott theory on the hourly timeframe.

BTC/USD, H1 timeframe:

The formation of a correctional wave [B] can be seen, which is part of a large-scale simple zigzag [A]-[B]-[C].

It shows that the corrective wave [B] is moving sideways and appears to take a triple three (W)-(X)-(Y)-(XX)-(Z) form. The first two sub-waves (W) and (X) took the form of double zigzags, while the middle active sub-wave (Y) took the form of a triple zigzag W-X-Y-XX-Z.

It is assumed that we are currently in the final part of the second wave of the bundle (XX), which has a complex double zigzag formation W-X-Y. The active sub-waves of this double zigzag, that is, sub-waves W and Y are also similar to the double zigzags of a smaller wave level. However, the last sub-wave Y is not yet fully completed. We believe that the sub-wave [Y], which is the final part in wave Y, will take the price to the level of 44830.00.

At the indicated price level, the value of wave Y will be 50% of wave W. At the moment, one can consider opening sell deals from the current level in order to take profit at 44830.00.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.