See also

25.12.2023 07:05 AM

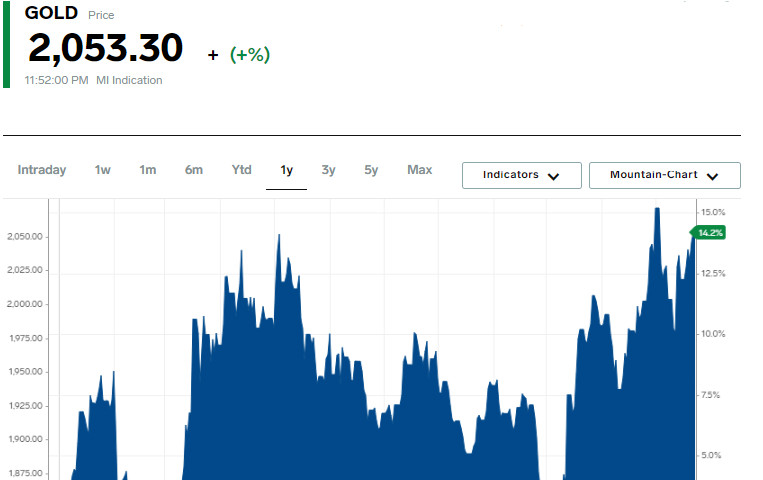

25.12.2023 07:05 AMAt the end of the week, gold showed a significant increase, reaching its highest level in the last two weeks. This rise was prompted by a decrease in the yield of the U.S. dollar and bonds, amid speculations about the Federal Reserve's potential rate cuts early next year.

The spot gold price rose by 0.4%, reaching $2052.69 per ounce, marking its highest level since December 4 and indicating a weekly increase of 1.7%.

U.S. gold futures also saw a rise — up by 0.9%, reaching $2069.1.

Tai Wong, an independent metals trader from New York, noted, "The increase in precious metals prices, including gold, is linked to expectations of aggressive rate cuts by the Fed. Market forecasts anticipate a reduction of 150 basis points by 2024."

Traders are confident that the U.S. central bank will start lowering rates as early as March, based on the latest data showing a decline in inflation.

In November, the annual U.S. inflation rate fell below 3%, and the core price pressure continued to weaken.

The U.S. dollar index reached a five-month low, enhancing gold's attractiveness to international investors. The yield on 10-year bonds was also close to its July low.

Philip Streible, Chief Market Strategist at Blue Line Futures in Chicago, predicts further growth in gold due to a decrease in bond yields and the dollar index, as well as concerns about economic slowdown.

"A technical breakthrough could push gold prices to the $2100 mark, retesting recent highs," he added.

On the physical market in India, gold demand fell due to high prices.

Silver prices fell by 1.2% to $24.12 per ounce, palladium dropped by 0.9% to $1202.46, and platinum rose by 0.7% to $969.67. All three metals showed growth for the second consecutive week.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.