See also

18.03.2025 01:11 PM

18.03.2025 01:11 PMUS stock indices closed with solid gains yesterday. The S&P 500 rose by 0.64%, while the Nasdaq 100 added 0.31%.

Asian stocks are also up for the third day, driven by gains in Japan and Hong Kong. Investors continue shifting toward non-US assets due to uncertainty caused by Donald Trump's policies. Hong Kong's indices gained about 2%, supported by a record surge in BYD Co. shares. The company unveiled a new EV charging system yesterday, which triggered stock purchases. Meanwhile, Japan's indices rose by over 1% after Berkshire Hathaway Inc. increased its stakes in the country's largest companies, reinforcing expectations of long-term growth.

During today's Asian session, US index futures corrected slightly, while European markets moved higher. Investors are exploring alternatives after the US stock market plunged earlier this month. Chinese and Japanese stocks have emerged as key buying opportunities. China's focus on stimulating domestic consumption should make its economy less vulnerable to Trump's tariff policies, further fueling demand for riskier assets. Positive rhetoric from Beijing is supporting Asian markets, and increased investments from figures like Warren Buffett could attract more major players.

Gold surged to a new all-time high, exceeding $3,017 per ounce. Meanwhile, the yield on 10-year US Treasury bonds dipped below 4.29% as the Federal Reserve begins its two-day policy meeting today.

Japan's stock market also gained ahead of the Bank of Japan's upcoming decision. The central bank is expected to keep interest rates at 0.5%, which could temporarily weaken the yen against the US dollar.

In Europe, German lawmakers will vote today on a bill that could unlock hundreds of billions of euros for defense and infrastructure spending. If passed, the euro may strengthen further, signaling a broader shift in Europe toward easing fiscal controls.

As for macroeconomic data, US retail sales rose less than expected yesterday, with the previous reading revised downward. However, the so-called control group sales, which factor into GDP calculations, grew by 1% last month.

As for commodities, oil prices are rising for the third straight day as escalating tensions in the Middle East overshadow concerns about potential global oversupply.

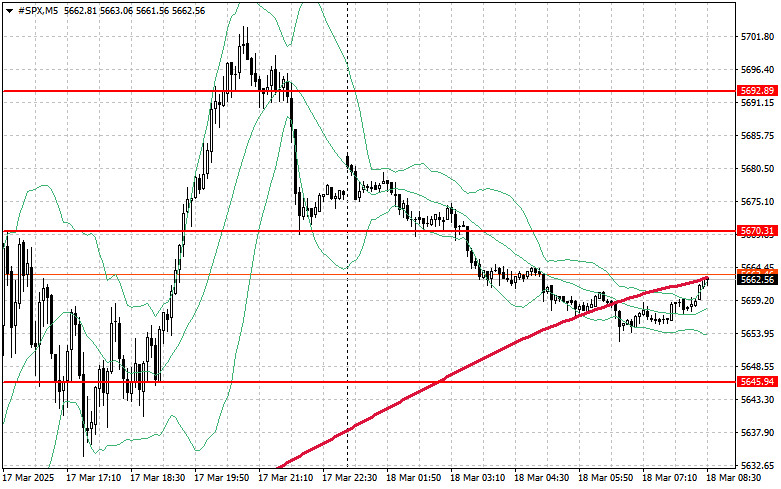

Technical outlook for the S&P 500

The decline in the S&P 500 continues. Buyers' main objective today is to break through the nearest resistance at $5,670, which could pave the way for higher growth and, push the asset toward $5,692. A key aim for bulls is also maintaining control over $5,715, which would strengthen their position.

If demand for risk weakens, buyers must defend the $5,645 area. A breakout below this level could quickly push the index down to $5,617, opening the door for a further drop to $5,586.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.