See also

27.03.2025 10:08 AM

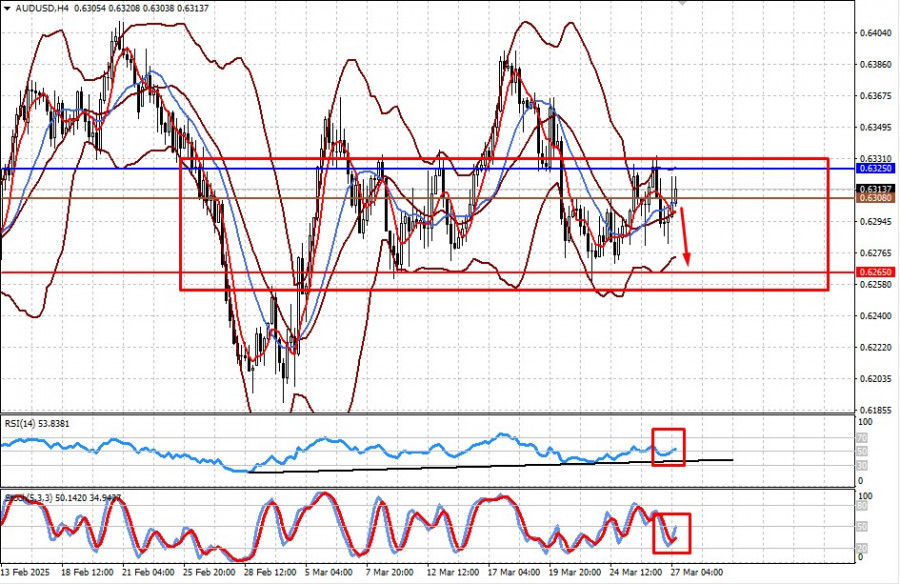

27.03.2025 10:08 AMThe Australian dollar remains in a consolidation phase, hovering within a narrow range of 0.6265–0.6325. Trump's upcoming implementation of tariffs against China and a number of goods from Australia is forcing market participants to act with extreme caution, keeping the pair in consolidation.

From a technical standpoint, it remains in range-bound trading, as the initial impact of U.S. tariffs and potential countermeasures from affected countries is still unclear. The pair will most likely stay within the 0.6265–0.6325 range until the end of the current week. Its inability to rise above the 0.6325 mark may result in a pullback toward the lower boundary of the range.

The price is above the middle line of the Bollinger Bands and the 5-day and 14-day SMAs. The RSI remains above the zero mark, and the Stochastic indicator shows a local upward reversal.

The pair may decline toward 0.6265, with the likely entry point at 0.6308.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

A consolidation at 1.1780 is needed above this level for a bullish outlook. So, the euro could then reach the level of 1.1829 and even the psychological level of 1.20

Once gold consolidates above $3,400 on the daily chart, it will be a good point to open long positions with a short-term target around the 8/8 Murray level at $3,500

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Graphical patterns

indicator.

Notices things

you never will!

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.