See also

22.04.2025 08:52 AM

22.04.2025 08:52 AMIt's impossible to inject capital into an economy destabilized by politics. Capital continues to flow out of the United States, and Donald Trump's attacks on the Federal Reserve only accelerate this process. At the same time, China isn't raising a white flag over the trade war and halting U.S. LNG imports. Investors doubt that Washington's negotiations with other countries will have a quick effect and continue to sell off the S&P 500.

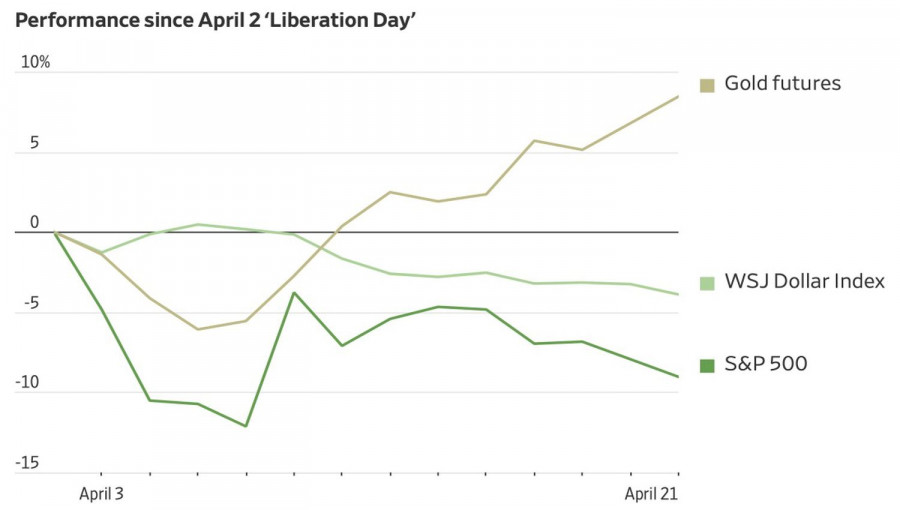

Plenty of time has passed since "America's Liberation Day," as the White House dubbed the day mutual tariffs were imposed, and conclusions can already be drawn. The biggest beneficiaries of the largest U.S. import tariffs since the early 20th century have been safe-haven assets led by gold. The losers? U.S. assets. The rise in Treasury yields and the falling dollar confirm they are no longer seen as safe harbors.

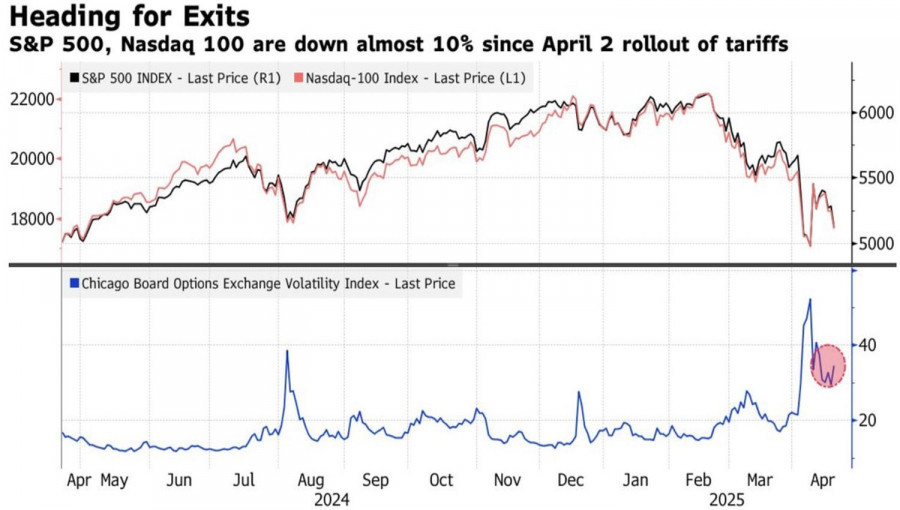

April may become the worst second month of spring for the Dow Jones Index since 1932. The S&P 500 has shown the weakest performance since the inauguration of any U.S. president, going back to 1928. And no matter how much Donald Trump brushes off the decline in stock indices, he continues to watch them closely. The president needs a scapegoat to explain what's happening, and he's found one in the Fed Chair. "Big loser" and "Mister Always Late" are the nicknames the Republican has used for Jerome Powell while demanding an immediate cut to the federal funds rate.

A similar story played out during Trump's first term, but the S&P 500 was rising back then, and investors dismissed his rants as eccentricity. This time, it's different. The broad stock index is sinking, and Trump's only apparent solution seems to be monetary easing. The opposite is happening: investors are fleeing, volatility is rising, and liquidity is drying up.

In April, trading volumes fell to 13.5 billion shares—well below the average of 20 billion. The market is eerily quiet, which is surprising given that April is shaping up to be one of the most volatile months. Comparable fluctuations occurred in October 2008 and March 2020—both during recessions. Today, the economic downturn seems to be more in investors' minds than on paper.

After every storm comes calm, investors await news on trade negotiations while dissecting the drama of Trump's criticism of Powell.

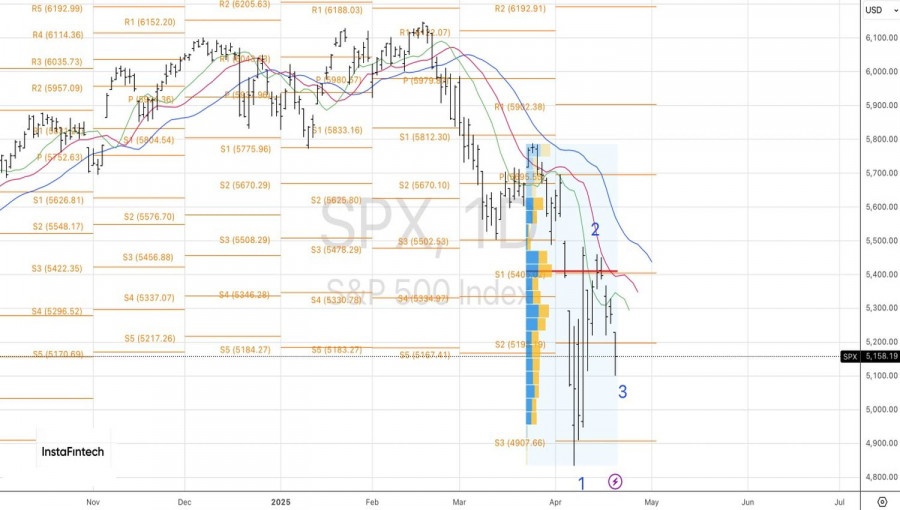

Technically, on the daily chart of the S&P 500, the bears are trying to reestablish a downtrend. A key condition is maintaining prices below 5190. As long as that holds, it makes sense to retain short positions opened from the 5400 level and build them up as the broad stock index continues moving south.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.