See also

24.04.2025 11:42 AM

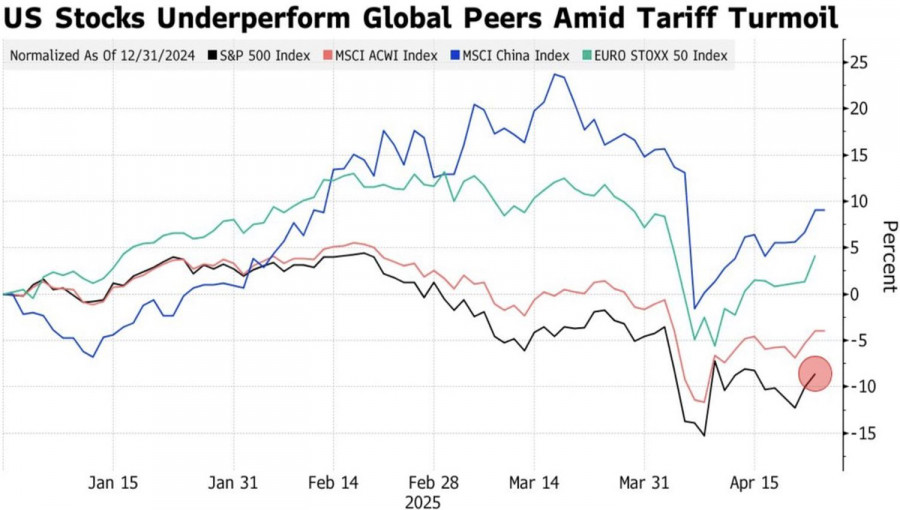

24.04.2025 11:42 AMThe market is showing heightened sensitivity to any good news, but its best days are behind it. The value of US equities as a percentage of the MSCI All Country World Index peaked in December. According to Jefferies Financial Group, investors should brace for further declines. A similar pattern occurred with Japanese equities in 1989, which was followed by sweeping global changes. Something similar may be in store for the US.

Although US equities account for 60-70% of the world's total market capitalization, America's economy does not generate a comparable share of global wealth. As a result, capital is flowing out of the US into other countries, a trend that has been accelerated by Donald Trump's protectionist policies. This phenomenon reflects not only American weakness but also investors' growing appetite for investing in Europe, Asia, and other regions.

Dynamics of US and other stock indices

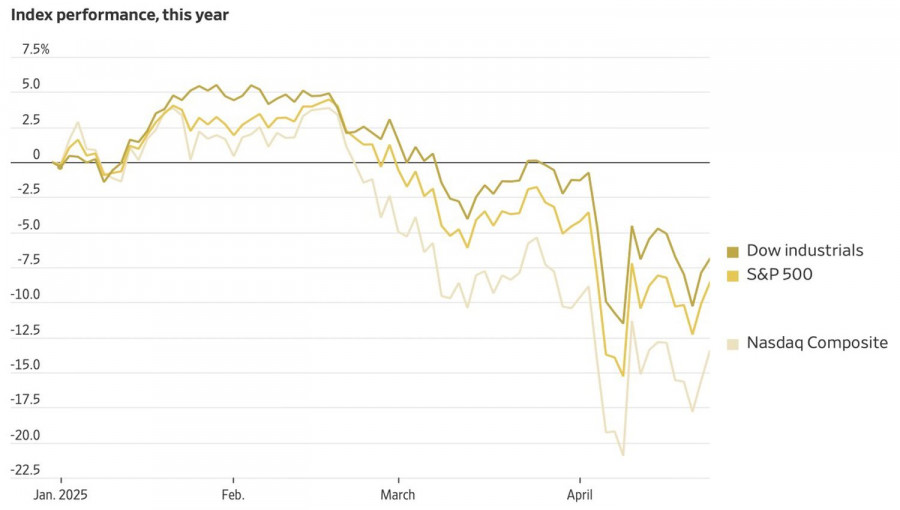

Since Donald Trump took office, the S&P 500 has fallen by around 10%, marking the worst performance in the first 100 days of any US president. It is no surprise that the Republican is growing anxious and is now backtracking on earlier decisions. After imposing tariffs on America's "Liberation Day," a 90-day pause was announced. Following his criticism of Jerome Powell, Trump announced that he did not actually plan to fire the Fed chair.

It seems Donald Trump is still glued to the S&P 500, and the market holds power over him. During his first term as president, the Republican repeatedly equated rallies in the index with his own effectiveness. With the president's well-known fixation on the stock market, some players are trying to exploit it. First came news of a tariff pause, which was later confirmed. Now, investors are rattled by rumors that the US may unilaterally roll back tariffs against China.

Although the US administration has denied the reports, there is rarely smoke without fire. What worked once may work again. Nevertheless, some traders chose to lock in profits after several days of gains.

Dynamics of US stock indices

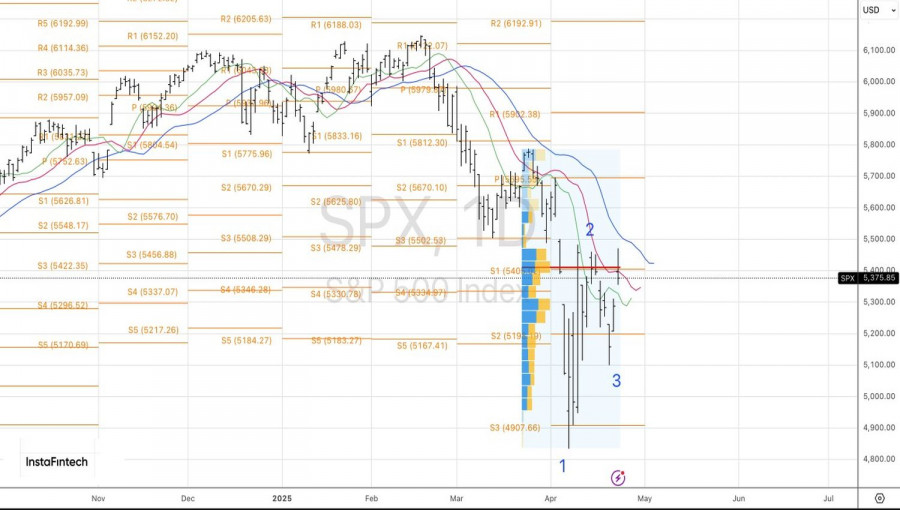

In this environment, the risk of medium-term consolidation in the S&P 500 is growing. Bulls are eager to buy the dip, yet they remain wary of fresh tariff threats and the risk of a recession. Bears seize on the adverse backdrop but retreat quickly on positive White House headlines. Buyers and sellers are engaged in a tug-of-war, which typically leads to the formation of trading ranges for specific financial market assets.

Technically, the daily chart shows that the S&P 500 tested the 5,400 level in an attempt to activate a 1-2-3 reversal pattern. However, the bulls' offensive was repelled, and the broad market index closed below this critical level. If the price breaks below the low of 5,350, it could become a signal to build short positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.