See also

25.04.2025 08:56 AM

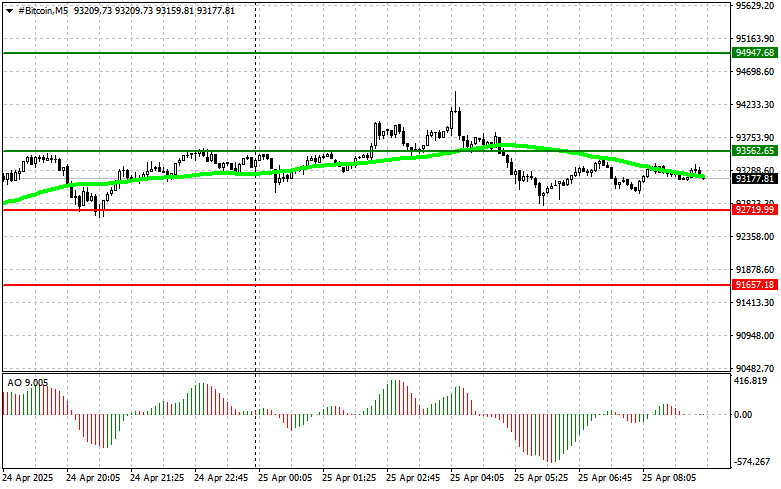

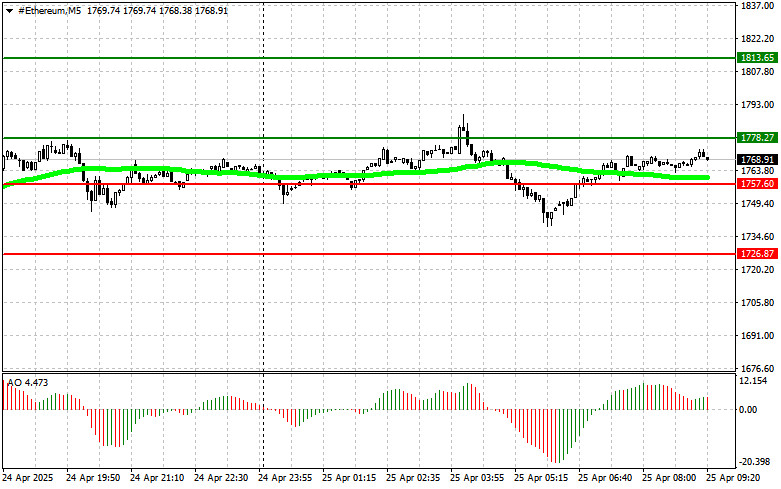

25.04.2025 08:56 AMYesterday's unsuccessful attempt to stay above $94,000 demonstrates that there is still significant buying interest. Ethereum is also holding up quite well, although yesterday's correction during the European session likely shook some nerves.

Meanwhile, according to recent data, whales actively withdraw BTC from exchanges. This trend has been ongoing for several months and, according to market analysts, may indicate a long-term accumulation strategy by large investors. The reduction in BTC supply on exchanges is generally seen as a bullish signal, as it lowers potential selling pressure and creates conditions for price growth.

Significant BTC outflows by whales reduce short-term liquidity, which can lead to sharper price fluctuations even on relatively low trading volumes. Some experts believe whales are preparing for the next bullish cycle by accumulating BTC for the long term. Others suggest it's driven by growing concerns about asset security on centralized exchanges and a desire for safer cold storage.

In any case, what is happening significantly impacts the mood of market participants.

As for the intraday strategy on the cryptocurrency market, I will continue to base decisions on major Bitcoin and Ethereum pullbacks, anticipating a medium-term bullish trend that hasn't gone anywhere.

As for short-term trading, the strategy and conditions are described below.

Scenario #1: Buy BTC at the entry point of around $93,500, aiming for $94,900. Exit long positions and sell on the pullback at $94,900.

Condition: The 50-day moving average must be below the current price, and the Awesome Oscillator should be in the positive zone.

Scenario #2: Buy BTC from the lower boundary of $92,700 if there's no market reaction to its breakout downward, aiming for $93,500 and $94,900.

Scenario #1: Sell BTC at the entry point around $92,700, with the aim of dropping to $91,600. Exit shorts and go long on a rebound at $91,600.

Condition: The 50-day MA should be above the current price, and the Awesome Oscillator should be in negative territory.

Scenario #2: Sell from the upper boundary of $93,500 if there's no breakout reaction upward, targeting $92,700 and $91,600.

Scenario #1: Buy ETH at $1777, aiming for $1813. Exit at $1813 and sell on the pullback.

Condition: 50-day MA below the price and Awesome Oscillator above zero.

Scenario #2: Buy from $1757 if there's no reaction to a downward breakout, targeting $1777 and $1813.

Scenario #1: Sell ETH at $1757, aiming for a drop to $1726. Exit at $1726 and buy the rebound.

Condition: 50-day MA above price and Awesome Oscillator in negative territory.

Scenario #2: Sell from $1777 if there's no breakout reaction upward, targeting $1759 and $1726.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.