See also

28.04.2025 07:03 PM

28.04.2025 07:03 PMThere's never a dull moment with Bitcoin. Sometimes it behaves like a risky asset, sometimes like a safe haven. At the beginning of April, the cryptocurrency was jokingly referred to as Nasdaq 100's errand boy. Now, as the second month of spring draws to a close, the token is being compared to gold. Bitcoin rose on rumors that Jerome Powell would be fired as Chairman of the Federal Reserve, and even after Donald Trump announced he had no intention of doing so, BTC/USD still climbed higher. Is Bitcoin a no-lose proposition?

In reality, the most important factor for cryptocurrency is that no one dares to openly oppose the President. Trump boldly criticized the Federal Reserve and challenged the central bank's independence. That suggests he won't face much resistance in promoting his idea of establishing a strategic Bitcoin reserve.

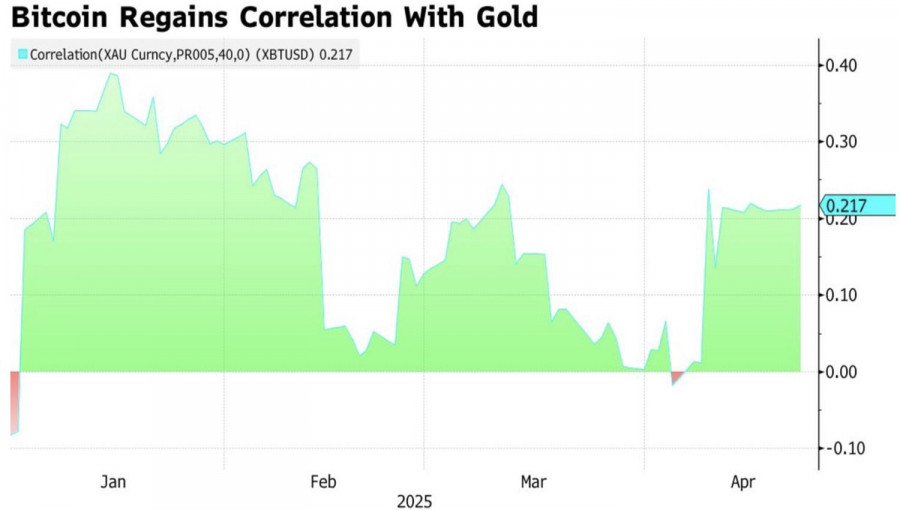

Political uncertainty in Washington has eroded investor trust in the U.S. dollar, benefitting safe-haven assets. Bitcoin has joined their ranks, as indicated by its increasing correlation with gold.

Gold-Bitcoin Correlation Dynamics

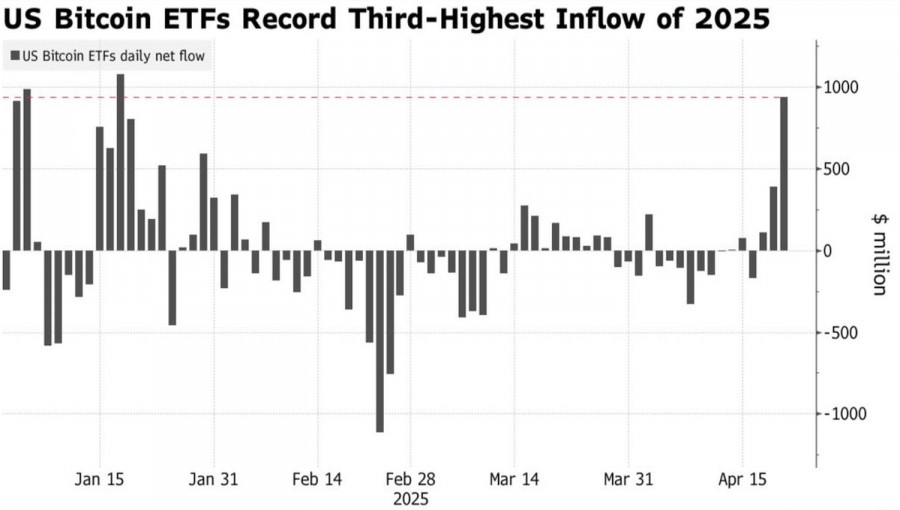

Cryptocurrency is now being used as a store of value, and the weakening of fiat currencies, led by the U.S. dollar, plays to Bitcoin's advantage. Capital has started flowing back into specialized exchange-traded funds (ETFs). Bitcoin-focused ETFs just recorded their third-strongest daily inventory rally since records began.

Another factor playing in BTC/USD's favor is the return of large institutional investors to the crypto market, buoyed by the 47th U.S. President's favorable stance toward digital assets. Merger and acquisition volumes are surging and could soon break the 2021 record of $17 billion.

Bitcoin ETF Capital Flow Dynamics

At the same time, traditional safe-haven assets like the Japanese yen, Swiss franc, and gold have retreated following the White House's conciliatory rhetoric. Logically, Bitcoin should have pulled back too — but it didn't. Investors are now left wondering: will Bitcoin once again fall under the influence of rising U.S. stock indexes at the end of April? Is it reverting to being a risk asset?The coming reaction of Bitcoin to the releases of U.S. GDP data for the first quarter and the April jobs report will be very telling. If the U.S. economy remains resilient despite aggressive protectionist policies, it could support stock indexes. Will Bitcoin follow?

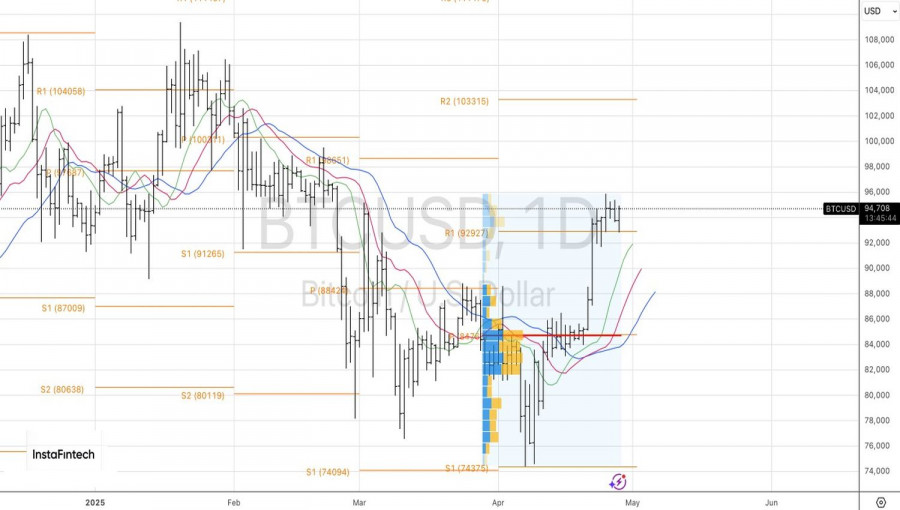

Technical Outlook:

On the daily chart, BTC/USD's rebound from the pivot level of 93,000 clearly showed who's in control. The bears are too weak, and bulls continue to dominate the market. Long positions initiated from 83,170 have proven to be an excellent decision, as has scaling up above 85,000. A new trigger for further cryptocurrency purchases would be the breakout of the local high at 95,850.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.