See also

08.05.2025 10:13 AM

08.05.2025 10:13 AMThe Fed is no longer the center of the financial universe, and the S&P 500's 13% rally from April lows has once again made U.S. equities expensive. That sums up the market's reaction to the results of the May FOMC meeting. The central bank left the federal funds rate unchanged at 4.5%, and Jerome Powell's remarks on the strength of the U.S. economy were enough for investor greed to overpower fear.

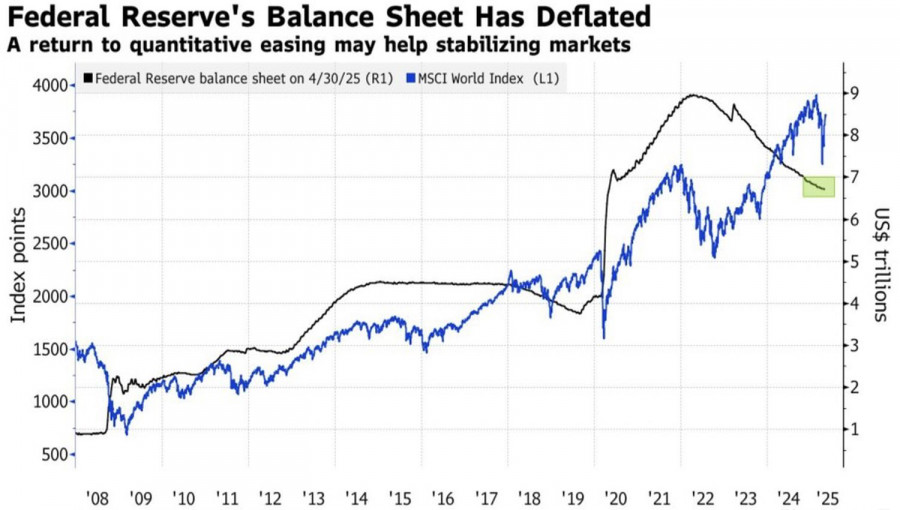

In previous years, only direct Fed intervention—including balance sheet expansion—could pull the S&P 500 out of the mud. This time, the central bank sees no need to throw a lifeline to the broad equity index. The White House is doing a fine job of that itself. Hints of de-escalation in trade tensions have become a stronger weapon in the bulls' arsenal than the Fed's willingness to cut rates.

Dynamics of the Fed Balance Sheet and Global Stock Market Index

The upcoming U.S.-China trade talks, President Donald Trump's announcement of a major deal with a serious and respected country—presumably the UK—and rumors that the new president might lift some of Joe Biden's restrictions on AI chip trade had a far greater impact on the S&P 500 than Powell's comments on U.S. economic strength.

The Fed's stated intention to hold the federal funds rate at 4.5% for an extended period could have scared the market. But why should the central bank cut rates before July 9, when Trump's 90-day tariff delay expires? It's the White House's policy uncertainty that underlies the Fed's passive stance.

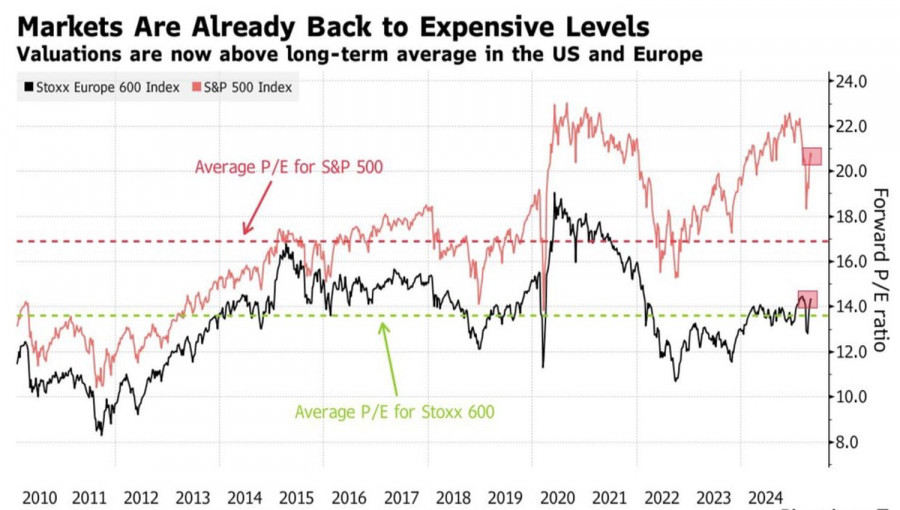

At the same time, the higher U.S. stocks rise, the more expensive they appear. The S&P 500's valuation now significantly exceeds that of its European peers, potentially triggering capital outflows from the New World to the Old, clipping the broad index's wings.

Dynamics of P/E Ratios Across Stock Market Indices

Still, Citigroup strongly advises clients not to dump U.S.-issued securities—even if the economy slows and companies begin revising earnings expectations due to trade wars. Leaving the U.S. market is not the best move; instead, investors should diversify their portfolios.

JP Morgan believes the S&P 500 is more likely to reach 6000 than to experience a serious decline from current levels. A stronger-than-expected earnings season, positive trade developments, and bullish sentiment among retail investors are expected to drive the index higher. In my view, if the market isn't spooked by Fed inaction, pleasant surprises from the White House could push it even further.

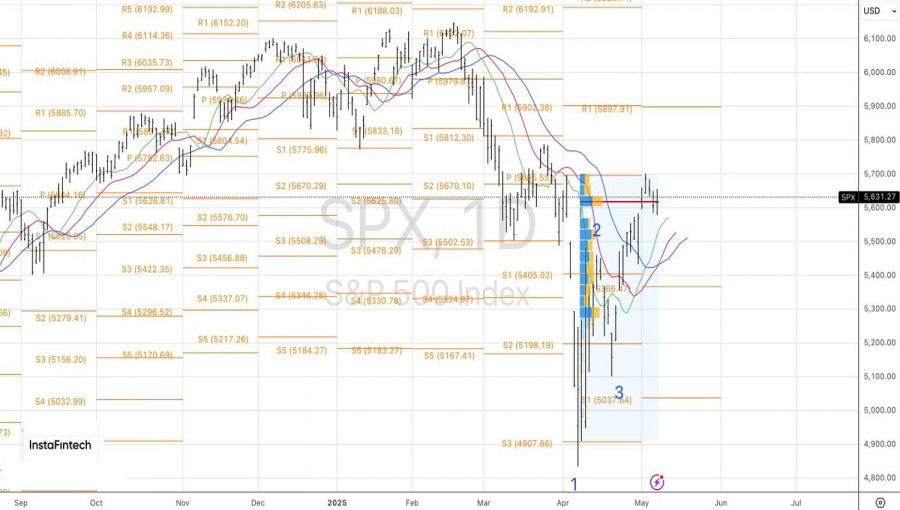

Technical Outlook

On the daily chart of the S&P 500, the bears' inability to keep prices below the fair value level of 5617 is a sign of weakness—and a reason to resume buying on breakouts above the resistance zones at 5655 and 5695.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.