See also

23.05.2025 08:04 PM

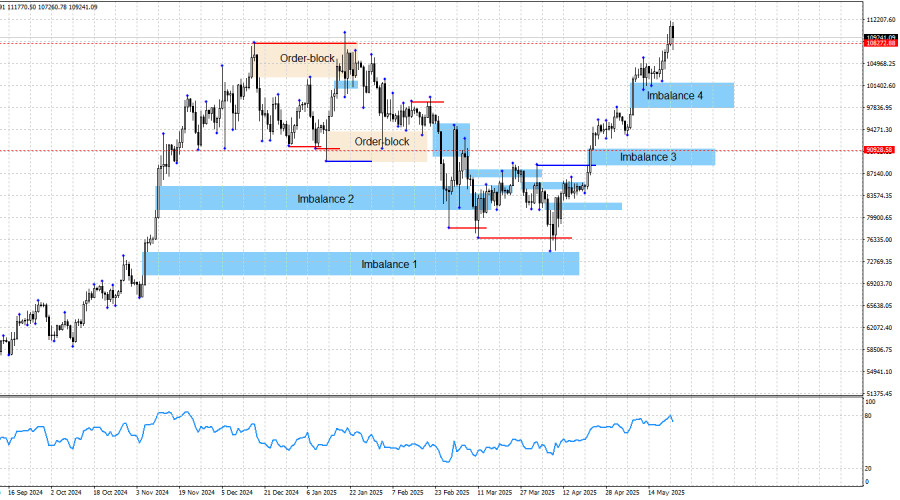

23.05.2025 08:04 PMBitcoin continues to form a bullish trend structure. One could argue whether there are real reasons for a new bullish trend at the moment, but the chart suggests only that—unambiguously. Since an upward wave is currently forming, traders can only wait for prices to enter zones of interest to have the opportunity to go long. These zones are Imbalance 3 and 4.

A return to either imbalance zone will mean the market has rebalanced price, after which Bitcoin's growth may resume. For me, these zones represent buying opportunities—but reversal patterns and confirmation signals on lower timeframes must appear within them. Bitcoin has returned to the nearest imbalance zone with some difficulty and immediately triggered a reaction, which for now has led to another strong upward move. Thus, from current positions, Bitcoin's rise can likely continue. There are no clear upper targets, as Bitcoin has never traded this high before.

I still don't completely rule out the possibility of liquidity being swept from the last high—$110,000. However, at the moment, there are no signs of this happening—bulls continue to steadily push upward without facing resistance from the bears.

At present, those who entered from the last Imbalance 4 zone can remain in their long positions. I expected the entry into this imbalance to be deeper, but in the end, price merely "kissed" its upper boundary. Nevertheless, that still qualifies as a signal—not the strongest, but a valid one.

Fundamental Sentiment

The informational backdrop has been rather weak lately, and the crypto market has shown little interest in it. Bitcoin has been rising for over a month almost without pause, and at the start of this rally, there was no positive news at all. Only recently have reports begun to appear about trade negotiations and tariff reductions between China and the U.S.—something that could theoretically support the bulls.

Bitcoin's performance over the past month has been stronger than the preceding decline, which occurred alongside global market turmoil. Thus, I do not believe the recent rally is fundamentally news-driven—traders seem largely indifferent to the news.

U.S. Economic Calendar:

However, news flow has had no influence on Bitcoin's price action lately. Whatever the headlines, Bitcoin keeps rising, regardless.

BTC/USD Forecast and Trader Advice:

Bitcoin has entered a phase of bullish trend formation. Therefore, my focus is on buy zones, regardless of the news backdrop. Buying should only be considered from Imbalance 3 or 4. Let me remind you: trade from zones of interest, not random chart levels. If price does not visit these zones or fails to produce signals, trades should not be opened. Alternatively, traders should work with other strategies.

Every return to one of these zones may represent a potential continuation of the uptrend. Bitcoin currently has no upside targets—it is trading at all-time highs.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.