See also

23.05.2025 08:09 PM

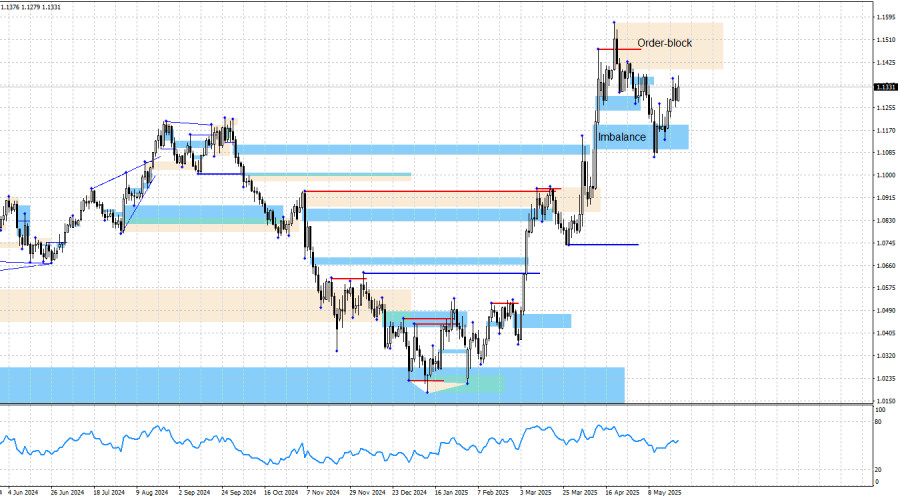

23.05.2025 08:09 PMAfter the breakdown of the bearish structure, we witnessed a strong rally in the euro, which, as of now, cannot be considered complete. The new bullish structure remains intact, and we've seen a corrective pullback into the two nearest bullish imbalances. Therefore, the euro's upward movement may continue in the near term. The second imbalance stopped the decline and triggered a bullish reaction.

I had expected a deeper correction back in March, but it didn't materialize following a Fed meeting or U.S. economic data. Instead, we had to wait for U.S.–China trade negotiations. Few in the market expected the very first meeting to result in a significant mutual reduction in import tariffs, but that's exactly what happened. However, for the U.S. dollar to resume its rally, new positive developments are needed—and there aren't many right now.

As such, positions opened from the most recent bullish imbalance can still be held. The nearest upward target is the bearish order block marked on the chart. Once this order block is reached, traders should monitor how the market reacts. A new decline in the pair is possible—but I'll remind you that for the dollar, much depends not on chart patterns or economic indicators, but on Donald Trump's decisions and news about trade agreements, which are currently the key drivers of market sentiment. A reaction from the order block may occur, but the news backdrop may prevent the bears from taking control.

On Friday, the fundamental background was essentially absent—except for Germany's GDP report, which beat trader expectations. As such, today's euro rally may be considered justified. That said, I expect the pair to continue rising regardless of surrounding developments.

News Calendar for the U.S. and Eurozone:

EUR/USD Forecast and Trader Tips:

The price reacted three times to the weekly bullish imbalance, broke the bearish structure, and thus continued the uptrend, as anticipated in recent weeks and months. As I've noted, none of this might have occurred—but fate made Donald Trump the President of the United States.

In my view, the pair may now be in the final stage of the bullish trend. New buy positions might no longer be the best trade idea. However, if the trade war intensifies and the U.S. economy continues to weaken, the dollar could fall with no bottom in sight. Traders must remember: this trend depends on Trump and his actions.

Reversal patterns formed on the lower timeframes in the bullish imbalance zone, making it a valid long entry with a target at 1.1397. Those trades can now be moved to break-even. Selling can be considered only after the bearish order block has been tested, but the trend remains bullish, so buying still takes priority. That said, if a strong sell signal emerges, it can also be acted upon.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.