See also

04.06.2025 09:53 AM

04.06.2025 09:53 AMAfter a sharp, almost catastrophic drop in March and April, the major U.S. stock indices recovered in May, fully offsetting the decline. Confidence is growing among market participants that this recovery might not be the final limit of investors' ambitions.

It seems the market increasingly understands that the U.S. economy cannot withstand a massive tariff confrontation with China due to their strong mutual dependence—one that notably leans in favor of the U.S. Therefore, it is believed that President Trump's maneuvering around this issue stems from a weak negotiating position and a desire to intimidate China to gain trade advantages. None of the extreme tariffs announced earlier are likely real threats—they are merely pressure tactics, something Beijing fully understands and appropriately assesses.

Most likely, the U.S. will have to back down and negotiate with China, which will lead to significantly lower tariffs—unless a crisis escalation and military conflict occur, something Washington, despite its bluster and bravado, is not prepared for.

Thus, the first reason for the ongoing demand for stocks is the geopolitical weakness of the United States. Markets believe the trade war will end in a compromise satisfactory to both sides. The second reason is the high likelihood that the Federal Reserve, despite its rhetoric denying a near-term rate cut, might be forced to act due to slowing economic growth and declining inflation. The third reason lies in investors' hopes that the U.S. economy will avoid sliding into a prolonged recession and that the labor market will remain at an acceptable level overall.

With such sentiments and the continued rebound of stock indices, bond yields, and the U.S. dollar, the markets are approaching this week's key labor market data releases.

Yesterday's JOLTS data, showing positive job opening dynamics for April and a revision upward for March, were encouraging. However, today, all eyes are on the ADP report on private sector employment, which, according to consensus forecasts, should show a gain of 111,000 jobs in May compared to 62,000 in April.

If the report meets expectations, the dollar could find limited support on the Forex market, and stock indices may finally break through the strong resistance levels that have held since mid-May. If the labor market report from the Department of Labor on Friday is also positive, this trend could accelerate.

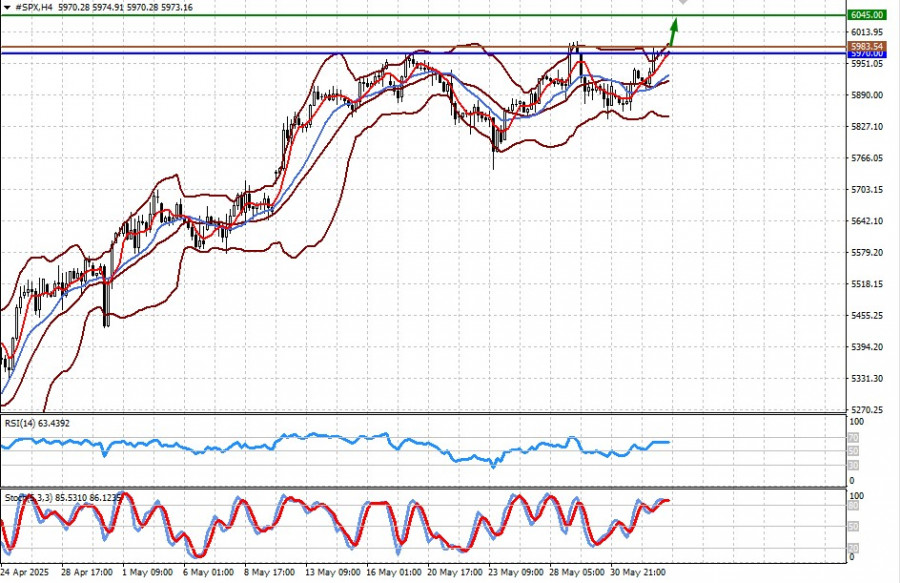

The CFD on the S&P 500 futures is trading near the strong resistance level of 5970.00. Breaking above it could lead to a renewed rise toward 6045.00. A potential buy point could be around 5983.54.

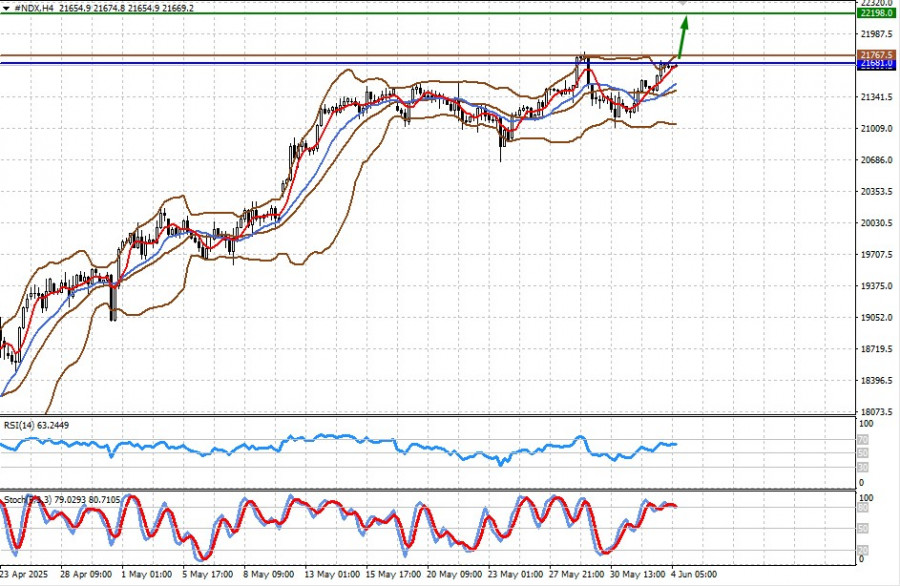

The CFD on the NASDAQ 100 futures trades slightly below the strong resistance level of 21,681.00. Breaking above it could set the stage for a rally toward 22,198.00. A potential buy point could be around 21,767.50.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.