See also

17.06.2025 08:23 AM

17.06.2025 08:23 AMPressure on risky assets returned in the afternoon of the U.S. session. This occurred right after euro and pound buyers failed to push prices to new monthly highs despite strong eurozone and UK economic data.

Today, attention will shift to economic indicators from Germany and the eurozone, specifically those published by the ZEW Institute. If the data comes in optimistic, it could strengthen the euro. Traders will closely examine the Current Situation Index and the Economic Sentiment Index to assess growth prospects in the region. Positive results may signal an economic rebound and boost confidence in the euro. However, if ZEW data is weaker than expected, the euro could be pressured. Negative business sentiment may trigger recession concerns and dampen demand for the European currency.

The Bundesbank's monthly report will also be of importance. Analysts will look for signals regarding Germany's current economic condition and any hints at potential changes in monetary policy. Any suggestion of a pause in the rate-cutting cycle or concerns about inflation could influence the euro's exchange rate.

There are no important economic reports from the UK today, giving pound buyers a chance to initiate a new wave of growth. However, it's important to remember that a lack of news does not necessarily imply a continuation of prior movements. While the market may respond to yesterday's developments, overall sentiment, and technical factors, traders should remain cautious and account for the possibility of sudden swings. A stronger pound could be driven by dollar weakness, positive developments from other economies, or technical breakouts above key resistance levels.

If data matches economists' expectations, use a Mean Reversion strategy. Use a Momentum strategy if data significantly exceeds or falls short of expectations.

Buy on a breakout above 1.1566, target: 1.1597 and 1.1628

Sell on a breakout below 1.1545, target: 1.1525 and 1.1505

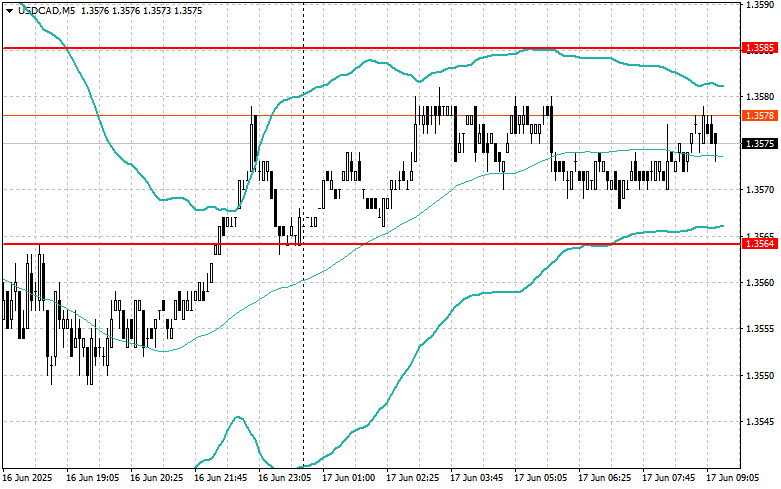

Buy on a breakout above 1.3580, target: 1.3599 and 1.3629

Sell on a breakout below 1.3555, target: 1.3535 and 1.3503

Buy on a breakout above 144.90, target: 145.28 and 145.63

Sell on a breakout below 144.53, target: 144.08 and 143.66

Sell after a failed breakout above 1.1574, once the price returns below

Buy after a failed breakout below 1.1543, once the price returns above

Sell after a failed breakout above 1.3585, once the price returns below

Buy after a failed breakout below 1.3552, once the price returns above

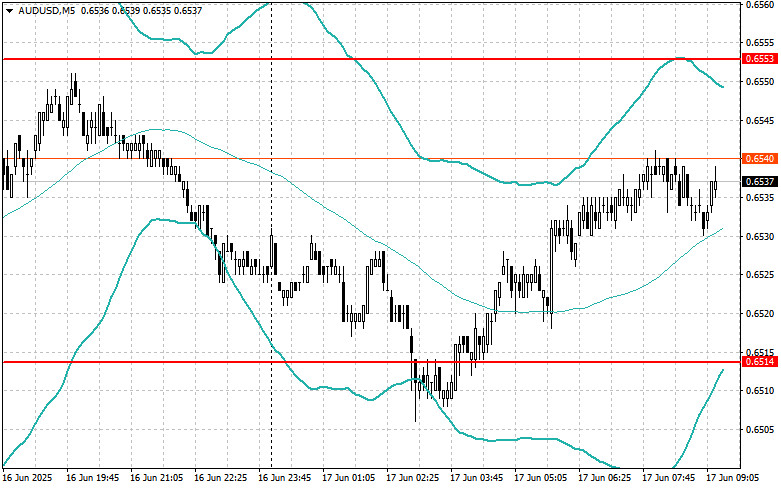

Sell after a failed breakout above 0.6553, once the price returns below

Buy after a failed breakout below 0.6514, once the price returns above

Sell after a failed breakout above 1.3585, once the price returns below

Buy after a failed breakout below 1.3564, once the price returns above

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.