See also

17.06.2025 12:10 PM

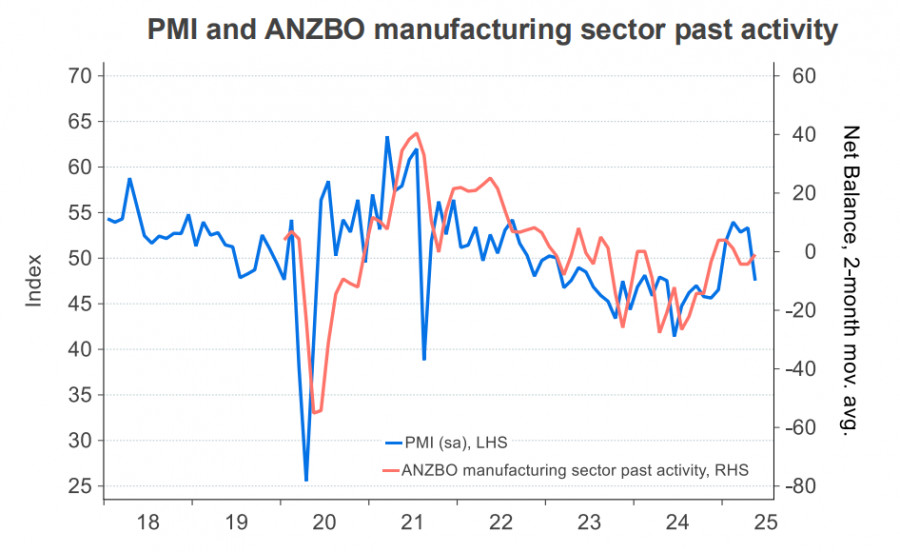

17.06.2025 12:10 PMWe previously noted that New Zealand's economy currently appears weak, and recent data has done nothing to challenge that assessment. The PMI indices deteriorated sharply in May, with the manufacturing index falling into contraction territory—from 53.3 to 47.5—while the services index dropped even further, from 48.1 to 44.0.

Nevertheless, regional banks assess the economic outlook with cautious optimism. For example, ANZ noted in its weekly report that output increased in the first quarter. These figures are already available, with a 2.4% rise marking the largest increase in two and a half years. It's not entirely clear how this production growth aligns with the drop in PMIs, but for now, we'll assume that a GDP contraction will be avoided.

The GDP report for Q1 is set to be released on Wednesday. After three consecutive negative quarters with contractions of -0.5%, -1.6%, and -0.8% respectively, growth is finally expected. Estimates vary—RBNZ expects 0.4% quarter-on-quarter growth, while ANZ is more optimistic, forecasting 0.7%. In any case, such a result would only signal the beginning of a recovery, rather than a confident expansion.

This figure will be important for predicting the Reserve Bank of New Zealand's (RBNZ) next steps. The outlook for the July meeting currently suggests an almost equal probability of a rate cut or a pause. If the GDP report comes in at or above the RBNZ's forecast, it will increase the likelihood of a pause and help the kiwi resume its upward trajectory. The current interest rate is already in neutral territory, and further cuts would only be justified by significant economic weakness.

In the longer term, three more rate cuts are expected before the end of the year, bringing the rate to 2.5%, where the easing cycle is expected to conclude. If this scenario plays out, the kiwi will look weaker than the dollar from a yield perspective and will lose momentum for further appreciation. However, if the GDP report exceeds expectations—hitting the upper forecast range of +0.7%—then NZD/USD may find fresh grounds to rally, as the RBNZ would be less likely to rush rate cuts, maintaining higher yields for longer.

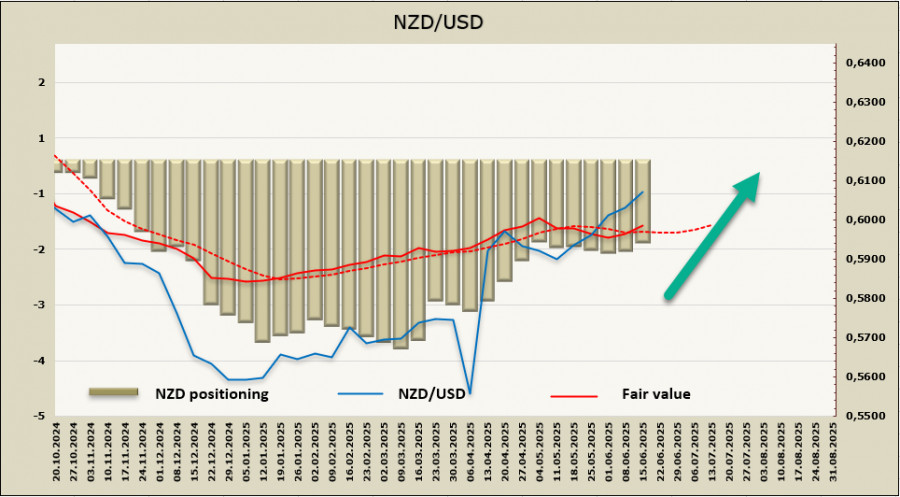

The net short position on the NZD declined by $135 million over the reporting week to -$1.285 billion. The bearish bias remains, but short covering continues, albeit at a slow pace. After a brief pause, the fair value estimate has once again moved above the long-term average, providing grounds to anticipate an end to consolidation and a resumption of NZD/USD growth.

In our previous report, we suggested that the resistance zone of 0.6010/30 would be tested, despite the kiwi having limited internal strength to drive gains. This has yet to occur, but our forecast remains unchanged—we still expect NZD/USD to resume rising. The foundation for a strong rally remains thin; the main driving force is the weakness of the U.S. dollar. Support lies at 0.6034, and we view the likelihood of a move below this level as low. If resistance is broken, the next target will be the local high at 0.6373.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.