See also

23.06.2025 05:56 PM

23.06.2025 05:56 PMToday, Monday, selling pressure on the Japanese yen dominates, driven by several factors. Traders continue to push back expectations of a potential rate hike by the Bank of Japan, assuming the next move may not occur before the first quarter of 2026. In addition, concerns about the negative economic effects of existing U.S. tariffs—25% on Japanese cars and 24% on other imports—are weighing on the Far Eastern currency, reducing its appeal.

As a result, the USD/JPY pair reached a new high since May 14 and approached the psychological level of 148.00. This comes amid moderate strengthening of the U.S. dollar and continued pressure from dollar bulls.

Despite Friday's release of Japan's annual Consumer Price Index (CPI), which significantly exceeds the Bank of Japan's 2% target, and higher-than-expected PMI figures from Japan—factors that should push the Bank of Japan toward further rate hikes in the coming months—yen bulls have not received support.

These factors indicate that the path of least resistance for USD/JPY remains upward.

On the U.S. dollar side, the Federal Reserve projects two rate cuts this year; however, officials forecast only one 25-basis-point cut in both 2026 and 2027. This stance is driven by concerns that tariff measures by Donald Trump's administration may lead to rising consumer prices, thereby supporting the U.S. dollar and creating favorable conditions for its continued strength in the currency market.

From a technical perspective, prices have broken above the 100-day SMA and the 147.00 psychological level. Oscillators on the daily chart remain in positive territory, confirming the bullish outlook for the pair.

Resistance was encountered at the 148.00 round level. If this level is broken, the next resistance will be the May high.

Support is expected at the 147.00 psychological level and the 100-day SMA around 146.80, followed by the familiar range that has been observed for the past three weeks.

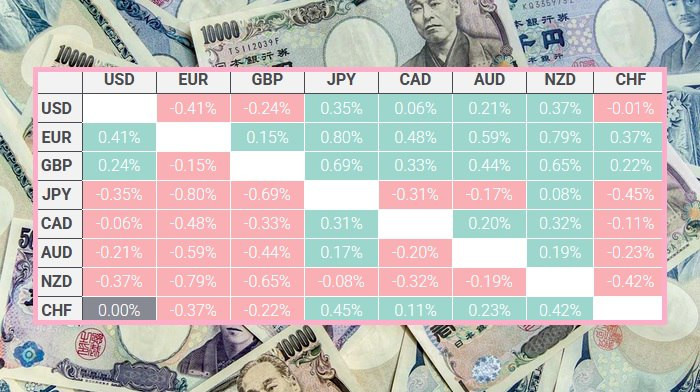

The table below shows the percentage change of the Japanese yen today relative to the listed major currencies.

The Japanese yen has shown the most strength against the New Zealand dollar.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.