See also

26.06.2025 09:21 AM

26.06.2025 09:21 AMThe yellow metal is once again receiving support driven by two main factors. The first is the continued risk of failure in the negotiations between Tehran and Tel Aviv. The second is related to the chronic weakness of the U.S. dollar amid the American economy slipping into a recession, which may persist for a prolonged period, and the uncertainty surrounding the future global impact of Donald Trump's customs tariff policy.

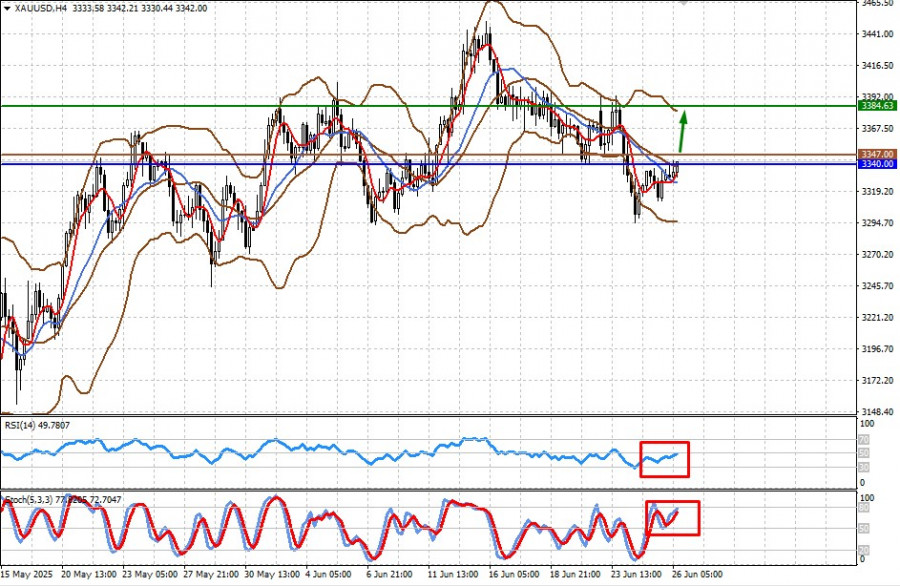

From a technical perspective, gold prices continue to be in a long-term upward trend. The bullish momentum, driven by the aforementioned reasons, may continue after breaking and consolidating above the 3340.00 level.

The price is trading above the middle line of the Bollinger Bands, as well as above the 5- and 14-period SMAs, which have crossed and are giving a buy signal. The RSI is crossing the 50% mark, also indicating a buy. The Stochastic Oscillator is above 50% and continues to rise.

In this situation, I believe gold should be bought, with a potential rise toward 3384.63. A likely entry point for a buy position could be considered around 3347.00.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.