See also

10.07.2025 12:02 PM

10.07.2025 12:02 PMThe split within the Federal Reserve, NVIDIA's successes, and a successful auction of 10-year US Treasury bonds allowed the S&P 500 to ignore the tariff chaos. Donald Trump announced tariffs on copper starting August 1 and sent additional letters regarding tariff rates on imports. Nevertheless, the broad stock index surged upwards. Investors once again bought into the dip.

One of the reasons the FOMO (Fear of Missing Out) phenomenon has returned to the financial markets is the resilience of the US economy to the tariffs already imposed by the White House. Inflation isn't speeding up. Some FOMC members believe the trend will remain downward. If there are any spikes, they will be temporary. Two officials are ready to vote for a rate cut in July. Expectations for monetary stimulus are supporting the S&P 500.

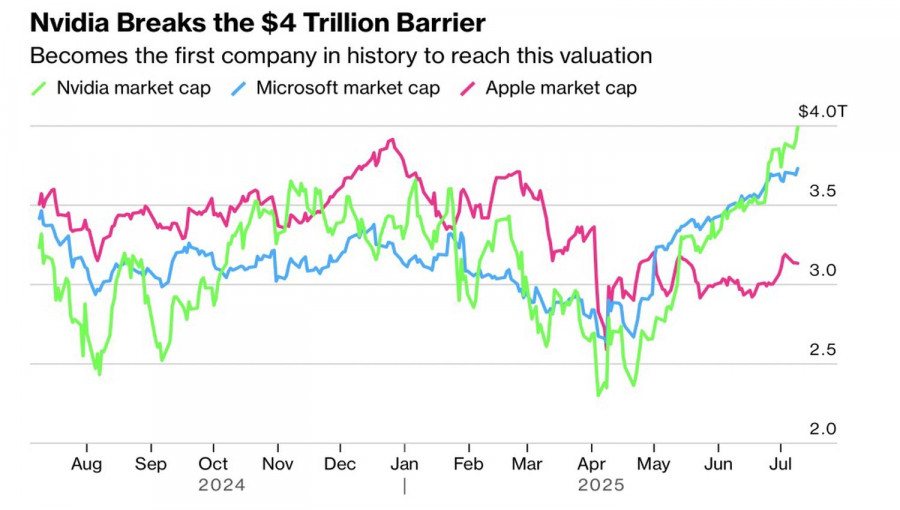

Moreover, the broad stock index has its leaders to follow. For the first time in history, the market capitalization of a single company has exceeded $4 trillion. That company is NVIDIA. Its stock has risen by 20% since the beginning of the year and by over 1000% since 2023. This tech giant now accounts for about 7.5% of the S&P 500 market capitalization, approaching a record high.

Performance of NVIDIA, Microsoft, and Apple stocks

The broad stock index was also supported by a successful $39 billion auction of 10-year Treasury bonds. The yield of 4.362% was below expectations, indicating strong demand. At the same time, the share of primary dealers dropped to 10.9%, compared to the average of 12% over the past six auctions. The decrease in bond yields positively impacts the S&P 500, as it reduces companies' costs.

The resilience of the economy, slowing inflation, and positive corporate earnings reports suggest that the rally in US stocks is likely to continue. Furthermore, Bank of America and Goldman Sachs have raised their forecasts, while BNP Paribas claims that trading advisors and volatility-related funds are ready to invest $20 billion in the S&P 500 within a week. The neutral positioning of these investor categories suggests that the broad stock index will continue its upward movement.

At the same time, Northlight Asset Management warns that the final impact of tariffs on the US economy and corporate profits from American issuers has yet to be seen. There have been many delays and cancellations of import tariffs. It will take time for them to fully manifest. Therefore, investors need to be cautious.

Technically, on the daily chart of the S&P 500, what was supposed to happen has happened. A short-term pullback to the downward trend allowed the "bulls" to buy the dip. Breaking the record high near the 6,290 level will allow the buildup of long positions formed at 6,051. Target levels of 6,325 and 6,450 remain in play.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.