See also

11.07.2025 10:50 AM

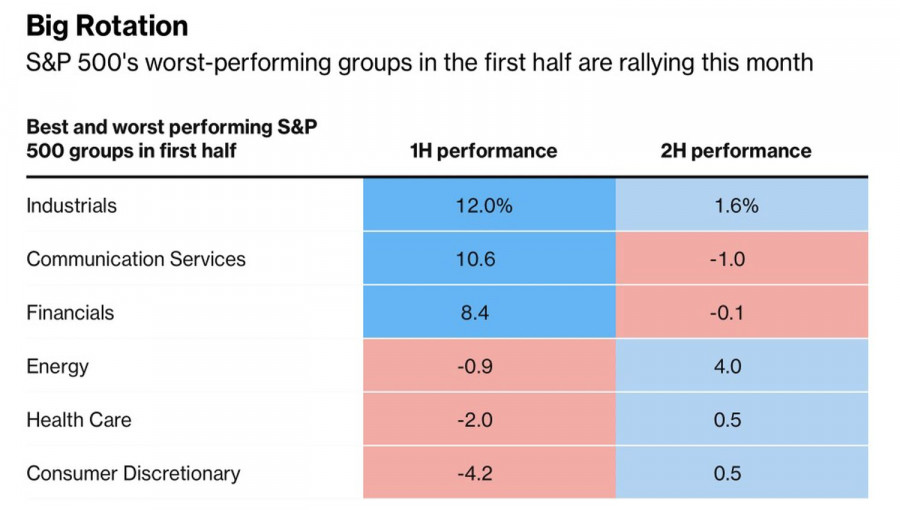

11.07.2025 10:50 AMThe S&P 500 reached another all-time high, with rotation being the hallmark of the US equity market. Investors are aggressively buying up stocks that underperformed in the first half of the year. Conversely, previous growth leaders are now lagging. For instance, energy companies — a notably weak sector from January through June — surged ahead in July. On the other hand, communication services, the second-best performer earlier, turned into the worst.

S&P 500 sector leaders and laggards

The core issue lies in the overvaluation of yesterday's winners. The price-to-earnings ratio for industrials, which led the first half, is now near the top of its 20-year range. In July, that sector ceded the spotlight to energy and materials.

Put simply, investors are not just buying S&P 500 dips. They are picking up anything that has not yet rallied. Coupled with successful auctions of 10- and 30-year Treasuries, this opens the door for a potential comeback in American exceptionalism. As a result, the US dollar is not faring as badly as it did in the first half of the year.

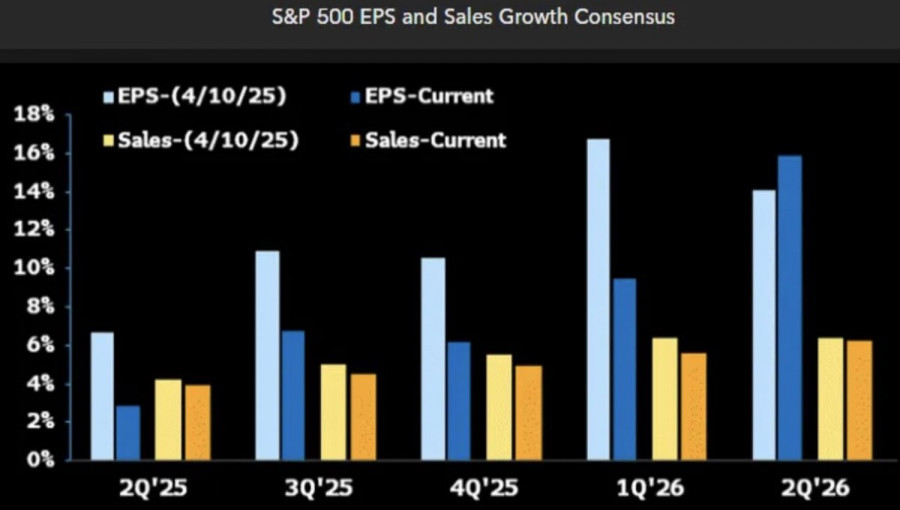

Investors are entering the second-quarter earnings season with optimism. According to FactSet, S&P 500 earnings are expected to grow 4.8%, marking the slowest pace since late 2023. However, lower estimates give companies a favorable opportunity to beat expectations. When actuals exceed forecasts, assets tend to rise. And the broad equity index is no exception.

S&P 500 earnings and sales forecasts

Despite its strength, pessimists have not disappeared. JP Morgan warns that investors are overly complacent about tariffs. The Sevens Report notes that the delay in tariff hikes until August 1 effectively kills off hopes for a July Fed rate cut. As tariff effects seep into the economy, the likelihood of monetary easing in September will also decline. This could weigh on the S&P 500.

Alongside rotation, another defining feature of the US equity market at midyear is the absence of fear. The imposition of 50% tariffs on copper and Brazil, the increase in duties on Canadian goods from 25% to 35% — none of this rattles the S&P 500. Investors strongly believe that such extreme scenarios will not materialize. Donald Trump will compromise. His bark is worse than his bite. As a result, S&P 500 dips are seen as buying opportunities.

Technically, the daily S&P 500 chart shows an ongoing uptrend. The index has come close to the first of two previously outlined targets at 6,325 and 6,450. As long as the broad equity index trades above its fair value at 6,225, bulls have nothing to fear. We recommend holding previously opened long positions.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.