See also

18.07.2025 12:26 AM

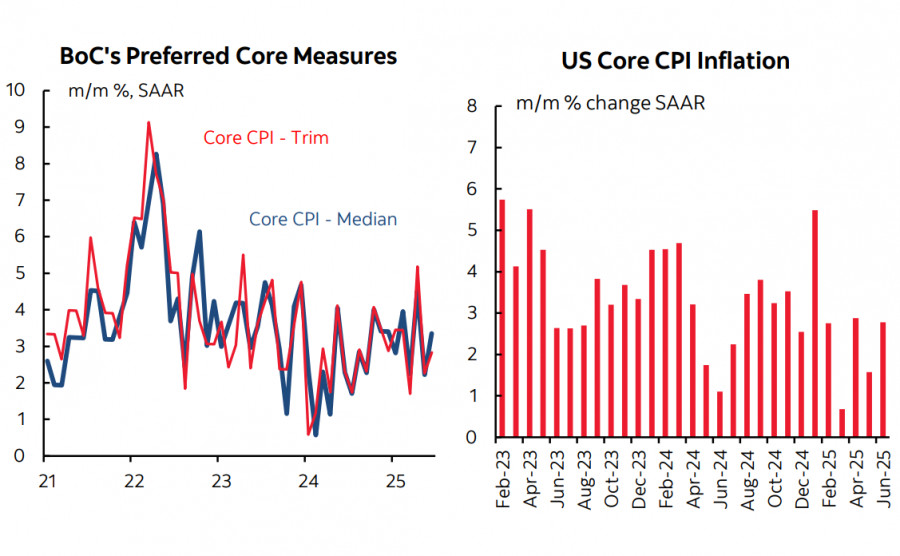

18.07.2025 12:26 AMCanada's Consumer Price Index rose in June from 1.7% y/y to 1.9%, while core inflation increased from 2.5% y/y to 2.7%. This growth remains within an acceptable range — not yet exerting significant pressure on the Bank of Canada to revise its rate strategy — but it is enough to warrant expectations of another pause in rate cuts.

Rate cuts are typically driven by two main factors: slowing inflation and a cooling labor market, which is seen as a reason to support the economy and ease financial conditions. However, even this second factor is now in question, given that 83,000 new jobs were created in June — a notably strong figure for Canada. And now, with inflation not only failing to decline but even poised to accelerate, the likelihood of continuing the rate-cutting cycle is approaching zero.

For the Canadian dollar, this is a bullish factor. However, it cannot fully play out yet, as the situation in the U.S. is quite similar: inflation there has also resumed its upward trajectory (at least based on the June data), and the labor market remains overheated.

Federal Reserve rate cut forecasts have already been revised to reflect a lower probability of easing, and that's why the Canadian dollar is unlikely to benefit from the Bank of Canada maintaining its pause. The market currently sees only 17 basis points of rate cuts priced in through year-end — less than one full rate cut.

At the moment, there are growing signs that the U.S. dollar may finally attempt to resume its rally after a prolonged period of weakness. Still, all forecasts could be upended overnight if a new unforeseen factor enters the scene. One such factor was the resurfaced threat to fire Fed Chair Jerome Powell during a meeting between Donald Trump and a group of Republicans on Tuesday. Trump reportedly asked their opinion on dismissing Powell and received a positive response, after which he announced his intention to follow through. However, just a few hours later, Trump denied the report, saying that Powell's dismissal was unlikely. Markets take such statements extremely seriously, as they touch on trust in the financial system. Even a retracted threat can trigger a renewed wave of dollar weakness due to a trust crisis.

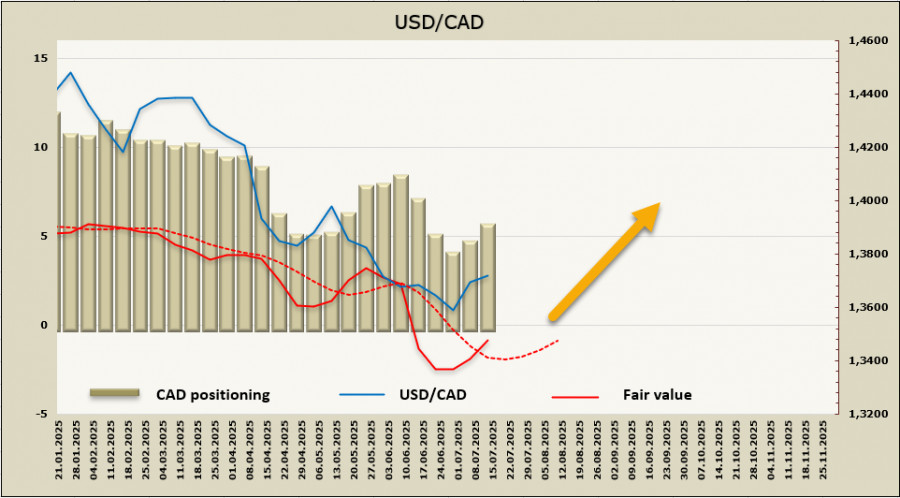

The net short position in CAD increased by 592 million dollars during the reporting week, reaching -5.24 billion. The estimated fair value has risen above the long-term average, pointing to continued growth potential.

The USD/CAD pair has formed a double bottom pattern, and more and more factors are pointing to the likely development of an upward movement. The probability of a return to the 1.3540/55 support area is decreasing, while a move toward the technical level of 1.3835 is becoming increasingly likely. The medium-term target is taking clearer shape near 1.4017, and we expect the upward move toward this level to be supported by both technical and fundamental factors.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.