See also

18.07.2025 04:46 AM

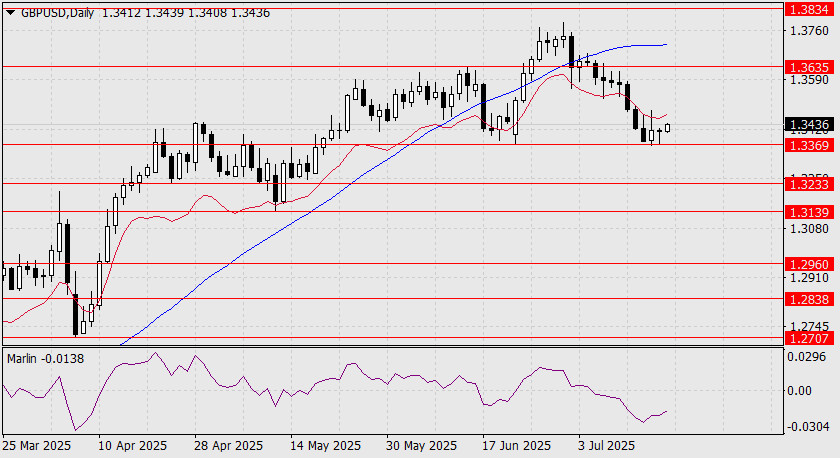

18.07.2025 04:46 AMThe British pound has decided to hold off on entering the narrower consolidation range of 1.3233–1.3369, instead turning upward this morning into the broader range of 1.3369–1.3635. This move was supported by increased risk appetite in the stock and commodity markets (S&P 500 up 0.54%, WTI up 1.76%).

The expected price growth is likely to be moderate, as it is unfolding below the balance line (the red moving average), and the Marlin oscillator will require at least three days (assuming the price continues to rise) to move into positive territory. The three-day stagnation at the 1.3369 level does not support a quick return to bearish sentiment, so a sideways movement within this established range is likely over the next 1–2 weeks, more precisely until the July 30 Federal Reserve meeting.

On the H4 chart, Marlin has entered positive territory. The price will likely attempt to reach the balance line and the MACD line at 1.3508. However, it is unlikely to break through this line today.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.