See also

18.07.2025 09:28 AM

18.07.2025 09:28 AMThe U.S. House of Representatives has passed bills establishing the first federal framework for dollar-backed stablecoins and setting regulations for other digital currencies.

The idea of regulating the cryptocurrency market has long been discussed, but has failed to gain sufficient support until now. Congress's decision to begin regulating the market for dollar-backed digital currencies is a significant development that will have lasting consequences. The U.S. is the first to start organizing what has been a largely chaotic crypto market, placing it within a legal framework and thereby cutting off outright fraudulent schemes in this relatively young financial sector. There's another key point in the adoption of these three bills: the U.S. is effectively monopolizing the legislative foundation, aligning it with its own financial and political interests. Pegging cryptocurrencies to the dollar will not only provide real backing for tokens, but also enable control over what is still a global market.

What impact will these measures have on cryptocurrency demand dynamics?

It's currently difficult to predict how the fragmented crypto market will respond. On the one hand, the start of real regulation will offer investor protection, significantly reducing the incidence of fraud. On the other hand, regulation may deter a large number of market participants who hope to get rich quickly by capitalizing on token price spikes followed by massive sell-offs.

So far, the cryptocurrency market has shown a relatively muted response to the news from the U.S., but shares of companies closely tied to crypto have surged, as investors view the upcoming changes as positive for those firms. Stocks of Coinbase, Robinhood, and Circle saw notable gains during yesterday's trading session.

Looking at the broader picture, crypto market investors may take a wait-and-see approach after token prices surged in anticipation of Congress's regulatory decision. It's also possible that the dollar's connection to cryptocurrencies will help support the U.S. currency itself, with crypto market transactions acting as a new foundation. In the future, the dollar may gain an additional anchor, similar to what happened with the petrodollar—this time, potentially becoming a cryptodollar.

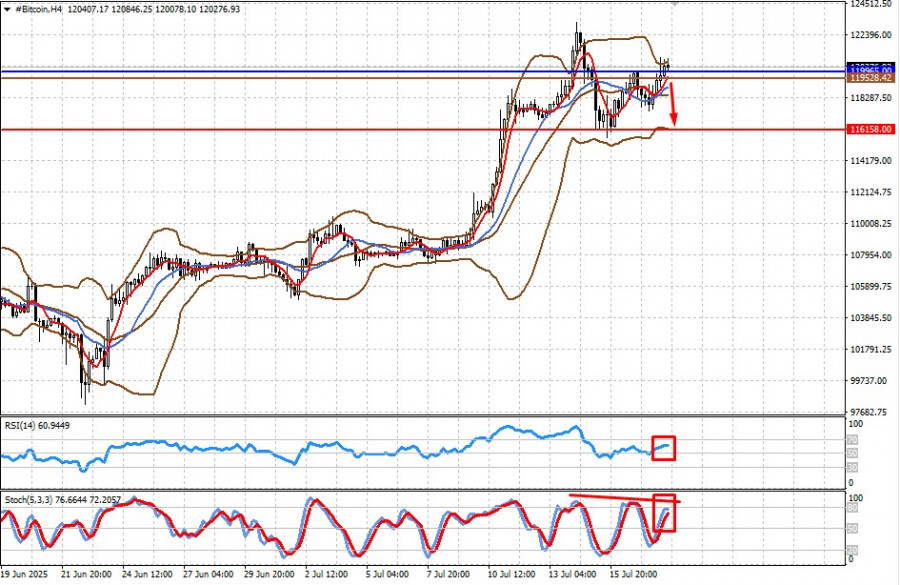

Following U.S. regulatory news, the token reached a new all-time high, but a correction is likely as traders digest the news and assess its long-term impact. Against this backdrop, Bitcoin may correct downward to 116,158.00 if it falls below the 119,965.00 level. A possible sell level is 119,528.42.

The pair is under pressure due to the possibility of another ECB rate cut, as inflation stabilizes near the 2% target. At the same time, the dollar has upside potential given the unclear outlook for Fed rate cuts. Considering this and the fact that the pair is trading below the resistance level of 1.1635, a corrective decline toward 1.1530 is likely. A potential sell level for the pair is 1.1603.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.