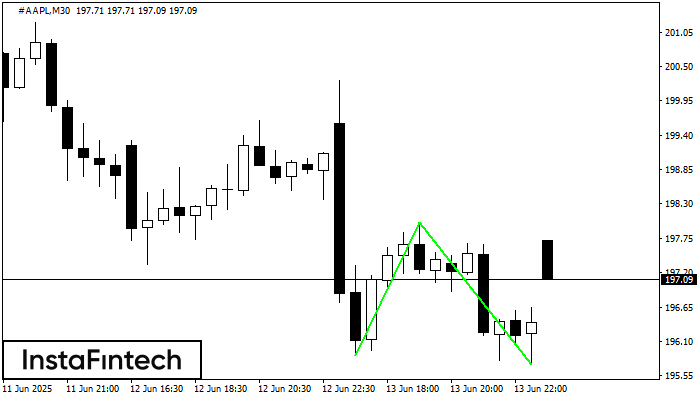

Double Bottom

was formed on 16.06 at 15:29:46 (UTC+0)

signal strength 3 of 5

The Double Bottom pattern has been formed on #AAPL M30; the upper boundary is 198.00; the lower boundary is 195.73. The width of the pattern is 213 points. In case of a break of the upper boundary 198.00, a change in the trend can be predicted where the width of the pattern will coincide with the distance to a possible take profit level.

Figure

Instrument

Timeframe

Trend

Signal Strength