Vea también

25.07.2022 07:03 PM

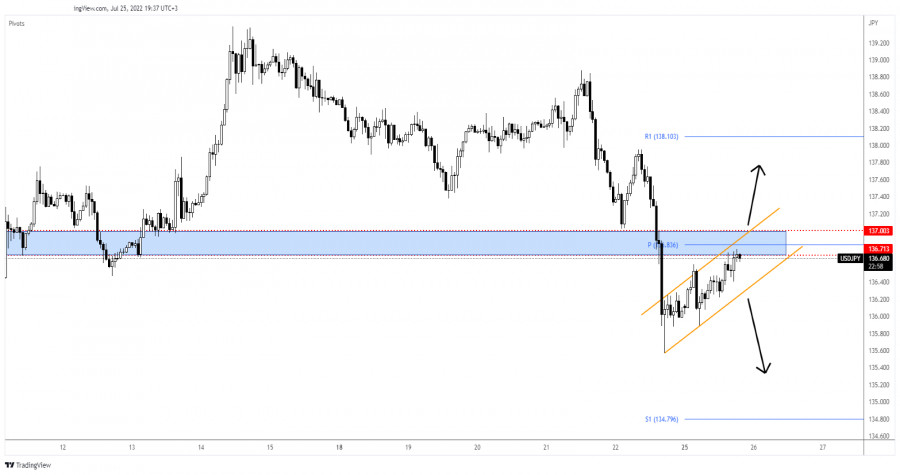

25.07.2022 07:03 PMThe USD/JPY pair rebounded as the Dollar Index seems oversold while the Japanese Yen Futures ended its growth. It was traded at 136.68 at the time of writing. Still, the current rebound could be only a temporary one.

Tomorrow, the Japanese economic data could change the sentiment. The Monetary Policy Meeting Minutes, SPPI, and the BOJ Core CPI could bring more volatility. The US CB Consumer Confidence could be decisive. Worse than expected US data could force the greenback to depreciate.

Fundamentally, the most important event of the week is represented by the FOMC. The Federal Funds Rate is expected to be increased from 1.75% to 2.50%.

As you can see on the H1 chart, the price turned to the upside after reaching 135.56. Now, it has developed an up-channel that could represent a bearish pattern. Now, it challenges the 136.71 - 137.00 resistance zone.

Staying below this zone may signal that the downside movement is not over yet. Only a valid breakout above 137.00 could announce further growth.

Testing and retesting the 136.71 - 13700 resistance area, registering only false breakouts, and making a valid breakdown below the uptrend line could announce a new sell-off. A new lower low, dropping and closing below 136.21 could bring new selling opportunities.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.

Desde principios de semana, el mercado del petróleo se mantiene en un equilibrio tenso. El Brent, que perdió su tendencia alcista de mayo, solo logró recuperar parcialmente la caída: tras

Ayer se formaron varios puntos de entrada al mercado. Vamos a mirar el gráfico de 5 minutos y analizar lo que ocurrió. En mi pronóstico de la mañana presté atención

Los futuros del petróleo Brent se acercaron a la zona de resistencia descendente, pero no lograron consolidarse por encima, retrocediendo hacia abajo. El panorama técnico sigue siendo tenso: el precio

El petróleo respira cambios. La política y la economía vuelven a entrelazarse en un nudo apretado, y los activos de materias primas —especialmente el petróleo y el gas— se convierten

Los futuros del petróleo Brent subieron a aproximadamente $71,3 por barril el martes, marcando la tercera sesión consecutiva de crecimiento, ya que la tensión en Medio Oriente eclipsó otros acontecimientos

El mercado bursátil vuelve a subir, con el S&P 500 en la cúspide de la euforia. ¿Qué será lo próximo? ¿Los aranceles y la política de la Reserva Federal reforzarán

El jueves, los futuros de las acciones estadounidenses permanecen prácticamente sin cambios después de un impresionante rally en la sesión de trading anterior, cuando el S&P 500 alcanzó máximos históricos

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.