Vea también

10.05.2023 12:39 PM

10.05.2023 12:39 PMECB Governing Council member Joachim Nagel said the central bank may be approaching the final stage of its historical cycle of interest rate hikes.

The head of the Bundesbank stated on Wednesday that even though the cost of borrowing has not yet finished rising, and core inflation still needs to be reined in, the results of the ECB's tight monetary policy are already satisfying.

"I am confident that monetary policy is showing its effect," Nagel commented.

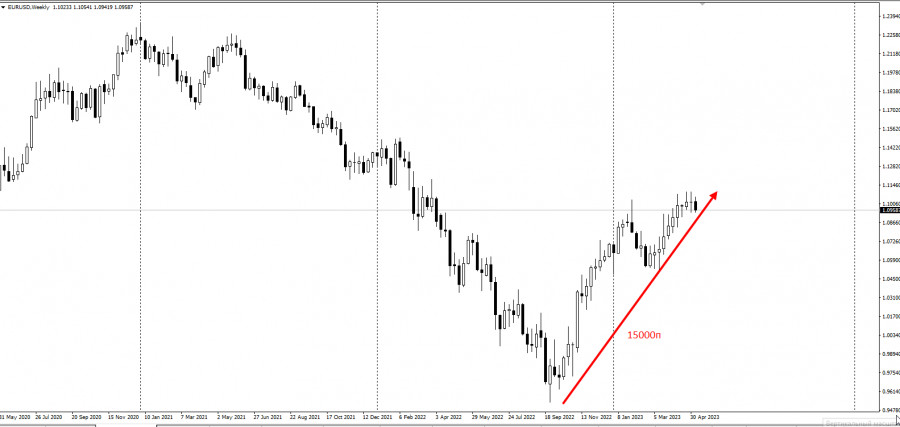

EUR/USD also gained over 15,000 pips since the end of last year, and signs of a slowdown are emerging.

Nagel's remarks also align with the majority of economists who believe that the ECB will raise the deposit rate twice more, in June and July, leaving it at a peak of 3.75%. Meanwhile, the Governor of the Bank of Greece, Yannis Stournaras, stated that the ECB's rate hikes would stop in 2023. Martins Kazaks from Latvia said that rate hikes could continue even after July.

Nagel characterized last week's decision to slow the pace of tightening while announcing an end to reinvestments under the Asset Purchase Program as the right step, although he emphasized that the job is not yet done.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.