Vea también

24.02.2025 03:19 PM

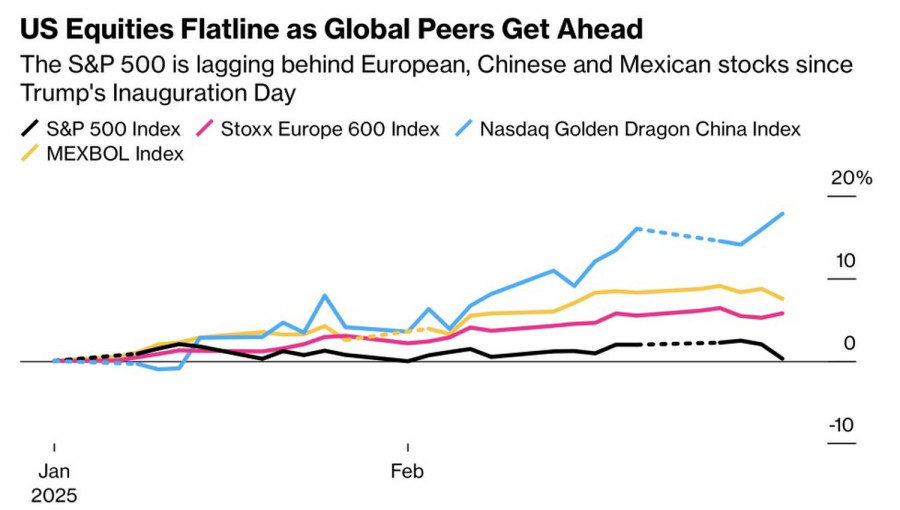

24.02.2025 03:19 PMThe animal spirits that propelled the S&P 500 up by 50% over the past two years are now taking on a global character. The capital shift from North America to Europe and Asia appears to be just beginning. The loss of the US stock market's exclusivity and signs of weakening consumer demand triggered the worst one-day decline in US equities since mid-December.

Global stock market trends

For a long time, the S&P 500 served as a safe haven for capital. The US economy demonstrated remarkable resilience against the Federal Reserve's aggressive monetary tightening, while the AI-driven boom made investing in the Magnificent Seven a no-brainer. Fears surrounding Donald Trump's tariff threats further boosted demand for US-issued securities.

However, as it became increasingly clear, the White House's tariff threats were merely part of negotiation tactics. So, as US high-tech giants faced growing competition from overseas, the market flipped upside down. Money began flowing out of North America at roughly the same pace it had rushed in during 2023–2024.

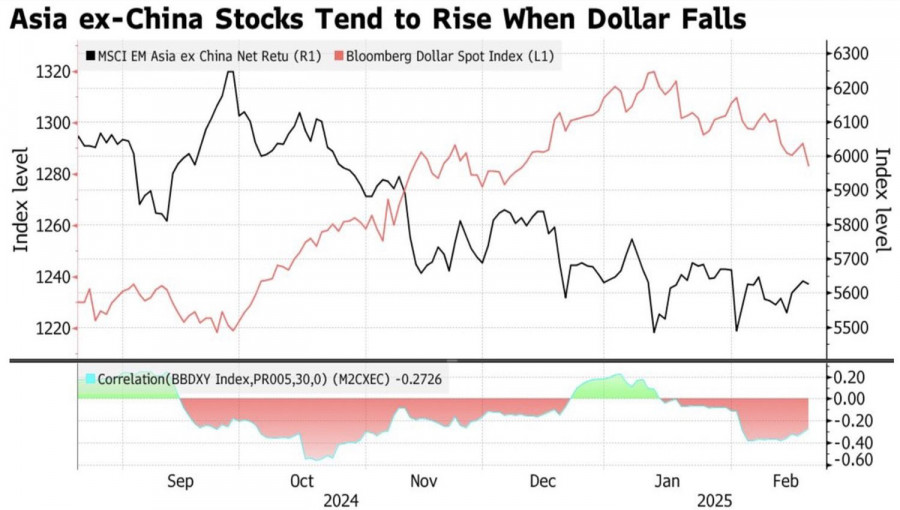

At the same time, the declining US dollar made foreign assets more attractive. Chinese stocks, for example, with a P/E ratio of 15, appear significantly cheaper than their US counterparts, which are trading at a P/E of 22.

Asian stocks and the US dollar

The rush to exit US markets is also fueled by signs of impending stagflation. Consumer confidence (University of Michigan) has plunged. Business activity in the services sector has contracted for the first time in two years. Inflation expectations have surged to their highest level since 1995. These signals point to an economy losing momentum while inflation risks accelerate. Chicago Fed President Austan Goolsbee attempted to calm the markets, stating that one report won't dictate policy decisions. However, investors chose to hit the sell button instead.

The market sentiment has shifted

Previously, bad news for the US economy was good news for the S&P 500, as it fueled expectations of a more dovish Federal Reserve. Now, bad news only fuels corrections.

Likewise, earlier speculation about lower-than-expected Trump tariffs supported the broad stock index, while now, such reports boost its foreign competitors. The Magnificent Seven are no longer market leaders—investors are actively seeking alternatives.

Strategic outlook

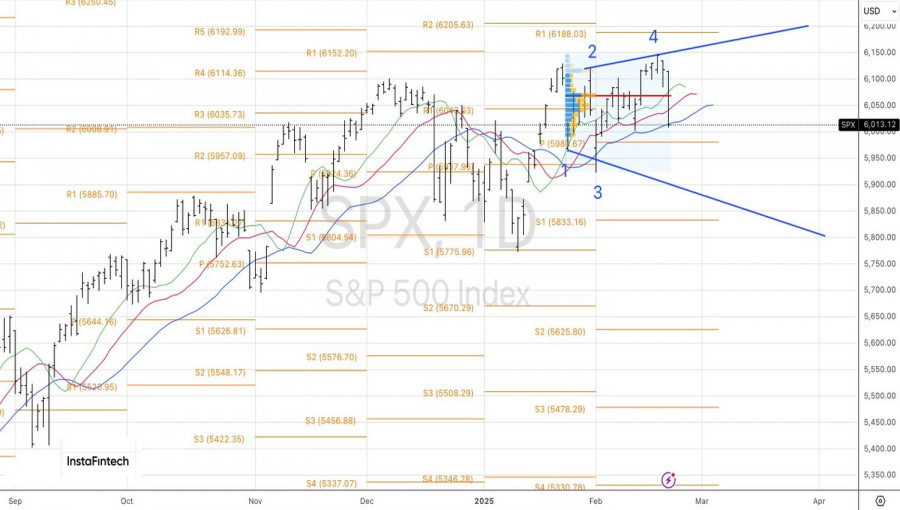

These shifts create an opportunity to implement paired trading strategies, simultaneously shorting the S&P 500 and buying its counterparts in Germany, Europe, or China—at least until mid-March, when the market starts pricing in the April 2 reciprocal tariff measures.

From a technical viewpoint, the daily chart of the S&P 500 is forming a broadening wedge reversal pattern. Shorts from 6,083 should be maintained and periodically increased.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.