Vea también

27.02.2025 10:49 AM

27.02.2025 10:49 AMNVIDIA's earnings report lacked the necessary spark, and the S&P 500 plunged after an initial rally. Meanwhile, Donald Trump's threat of imposing 25% tariffs on the European Union and the potentially severe consequences of the U.S.-China trade war could pose a much greater threat to the American economy than currently anticipated.

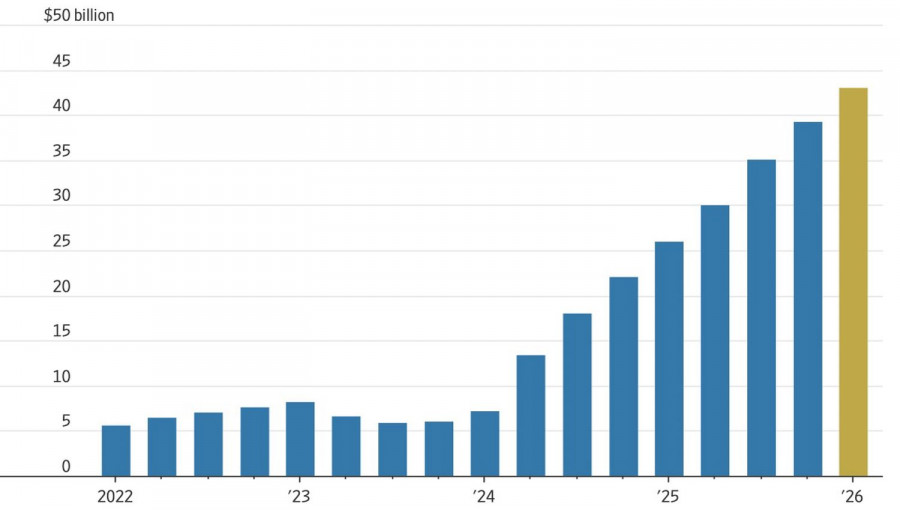

NVIDIA is viewed as a symbol of artificial intelligence (AI) technology, one of the key drivers that helped the S&P 500 rally by over 20% in 2023 and 2024. In Q4 2024, the tech giant's revenue surged by 78% year-over-year, reaching $39.3 billion. The January-March 2025 revenue forecast of $43 billion also exceeded Wall Street estimates.

One would expect NVIDIA's stock to continue its rally, but instead, it pulled back after an initial surge. Investors were concerned that revenue only exceeded consensus estimates by $1.2 billion—the smallest margin since the AI boom began in early 2023. Additionally, NVIDIA warned that its new product lineup—the Blackwell family of AI chips and full-fledged computing systems—would weigh on gross margins for most of 2025.

Investors were also alarmed by Donald Trump's announcement that the White House is considering imposing 25% tariffs on the European Union. Brussels has repeatedly stated that it has a list of retaliatory measures ready. A full-scale trade war between the U.S. and Europe would deal a severe blow not only to global trade and the economy but also to financial markets.

Furthermore, the consequences of U.S. protectionist policies against China may be far worse for the U.S. than currently expected. The issue lies in discrepancies between trade statistics.

According to U.S. data, from 2018 to 2024, the share of imports from China fell from 21.6% to 13.4%, and the trade volume dropped from $503 billion to $439 billion.

However, Chinese data indicates that exports to the U.S. only declined by 2.5 percentage points, while the total trade volume actually increased by $91.2 billion to $524 billion.

This discrepancy may be due to shipments under $800, which are currently exempt from U.S. tariffs. If these shipments are taxed, inflation in the U.S. could accelerate even further.

As a result, the Federal Reserve may be forced to keep the federal funds rate at 4.5% for longer than the market expects. Atlanta Fed President Raphael Bostic believes that the Fed is exactly where it needs to be, and with the central bank's employment targets met, its focus can now shift fully to inflation—a negative development for the stock market.

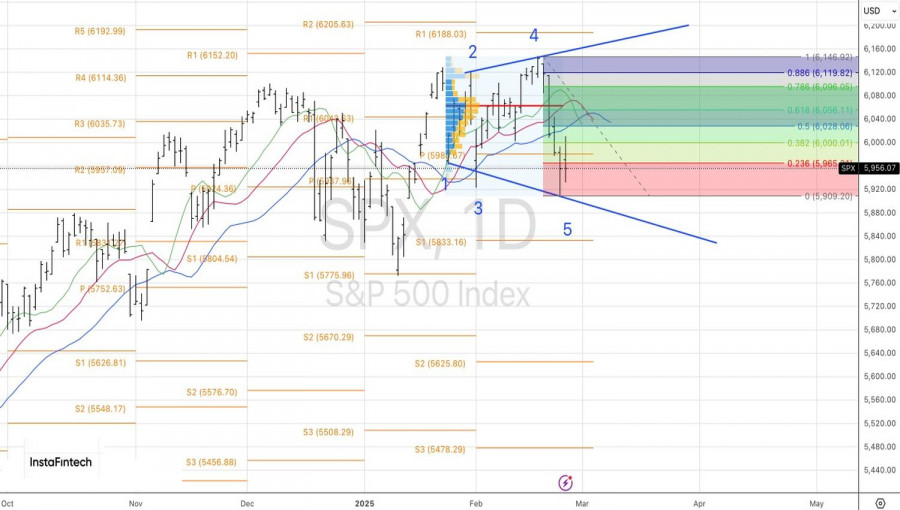

From a technical standpoint, on the daily chart, the S&P 500's retracement to 6,000—the 38.2% Fibonacci level from the 4-5 wave formation—provided an opportunity to increase previously opened short positions from 6,083.

These short positions should be maintained, with target levels at 5,830 and 5,750, marking potential low points for the broad stock market index.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.