Vea también

22.12.2025 02:01 PM

22.12.2025 02:01 PMBitcoin continues to tread along the edge of an abyss. According to estimates from STS Digital, a drop in BTC/USD below $85,000 may act as a gravitational pull. Positions totaling $1.4 billion are concentrated in this area. Their closure could trigger an avalanche and send quotes considerably lower. Furthermore, the cryptocurrency is poised to close the October-December period with its worst performance since the second quarter of 2022, when the collapse of TerraUSD and Three Arrows Capital shook the entire industry and led to the crypto winter.

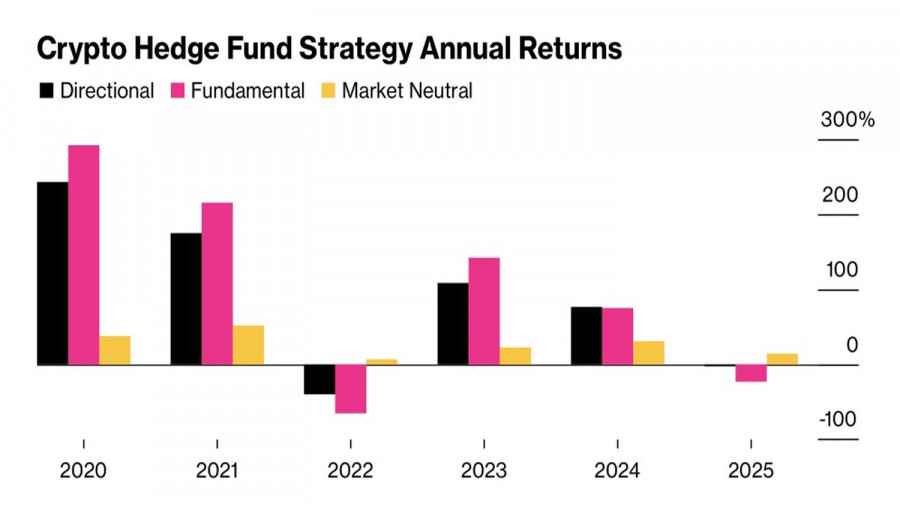

2025 has been an unfortunate year for hedge funds dealing with digital assets. Those who focused on profiting from large fluctuations in BTC/USD have lost about 2.5%. This marks the worst result since the infamous 2022. Financial institutions with long-term perspectives and positions in cryptocurrency saw a 23% decline. Only market-neutral funds, which capture profits from small fluctuations of the token, have managed to gain 14.4%.

Performance of hedge funds working with cryptocurrency

The investor outlook for 2026 is markedly different. Bears are worried about a repeat of the crypto winter. Bulls argue that Bitcoin has become mainstream, and even a 30% drop in BTC/USD from record highs hasn't changed that. The use of ETFs, crypto-friendly regulatory bodies, and the entry of major institutional investors into the market have made it more reliable and stable.

Yes, volatility leaves much to be desired. However, recently, the 30-day volatility indicator has been steadily rising, instilling hope that better times for cryptocurrency may return—times when Bitcoin was simply bought because it was rising.

Dynamics of Bitcoin volatility

Currently, the digital asset is facing problems with insufficient demand amid rapidly increasing supply. According to CryptoQuant, the last month saw the largest selling off of tokens from dormant accounts in the last five years. Since 2023, 1.6 million coins worth $140 billion have entered circulation.

Specialized exchange-traded funds are experiencing capital outflows, while crypto custodians have fallen into the trap of excessively low prices. They bought Bitcoin at higher prices and now face a difficult choice: continue buying in hopes of boosting the price or pause their activities and risk losing clients.

If it weren't for the US stock indices gearing up for a Christmas rally, the situation for cryptocurrency would be even worse. However, the growth of the S&P 500 has allowed it to continue consolidating. How long will this last?

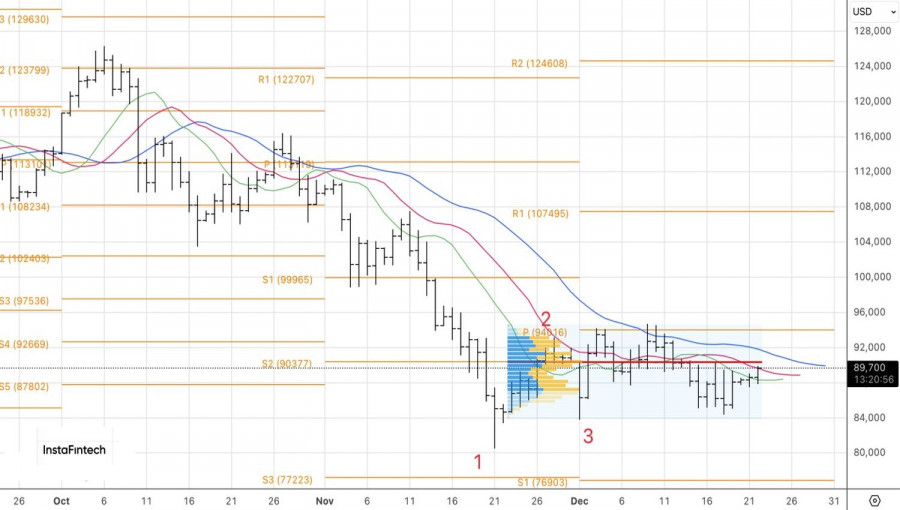

From a technical viewpoint, the daily chart for BTC/USD shows the formation of a shelf within a "Spike and Shelf" pattern. Bitcoin has stagnated in a trading range of $85,000 to $94,000. Only a breakout from this range will clarify the situation. It makes sense to set pending orders to buy the digital asset at the upper channel border of $94,000 and to sell at the lower border of $85,000.

You have already liked this post today

*El análisis de mercado publicado aquí tiene la finalidad de incrementar su conocimiento, más no darle instrucciones para realizar una operación.