See also

23.04.2025 12:08 AM

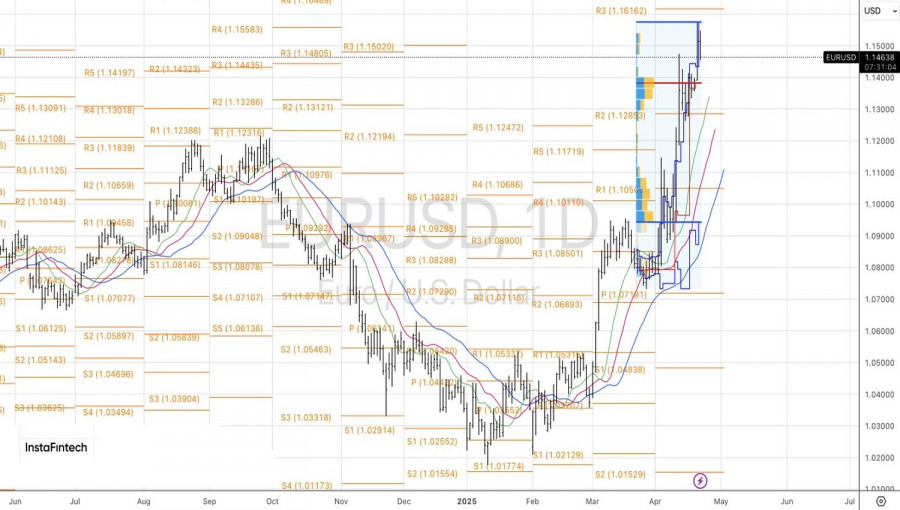

23.04.2025 12:08 AMFear paralyzes, but action persists. Investors are slowly overcoming their concerns over Donald Trump's attacks on the independence of the Federal Reserve and are starting to lock in profits on long EUR/USD positions amid the IMF's downbeat forecasts. Yes, the U.S. dollar is no longer viewed as a safe-haven asset, but the euro remains a pro-cyclical currency—its value is tied to the state of the global economy, which doesn't look particularly bright in the near term.

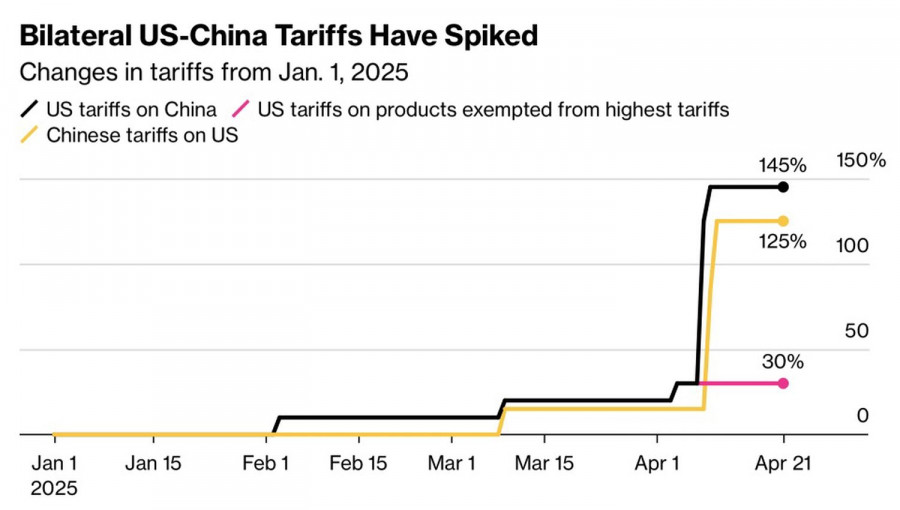

The IMF has cut its forecast for global GDP from 3.3% to 2.8% for 2025 and from 3.3% to 2.9% for 2026 due to the White House's tariff policy. China's economy is expected to slow to 4% this year and next, down by 0.6 and 0.5 percentage points from previous estimates. The U.S. will fall short by 0.9 and 0.7 percentage points, with GDP projected to grow by 1.8% and 1.7%, respectively. These are the consequences of a trade war between global heavyweights—and that's not even factoring in Washington's tariff hikes to 145% and Beijing's to 125%.

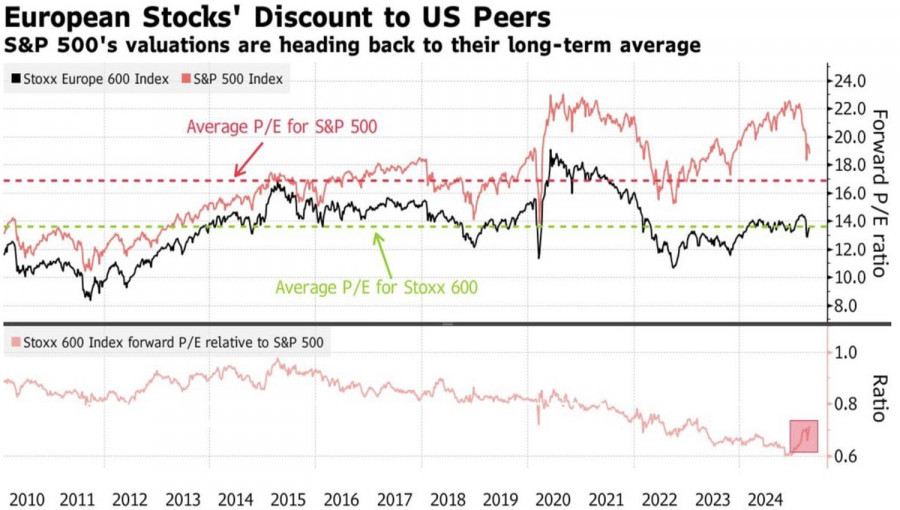

Investors are beginning to realize that the U.S., where exports account for only 11% of GDP, may suffer less than Germany and the eurozone, where export shares hover around 40%. However, this fact alone is insufficient to halt the ongoing capital flight from North America to Europe.

For a long time, U.S.-issued securities were the default investment choice. American exceptionalism attracted foreign buyers and strengthened the dollar, causing U.S. equity valuations to become significantly inflated. The growing distrust in the White House's policies has pushed foreign investors to flee the U.S. like rats from a sinking ship.

The dollar and U.S. Treasuries are no longer the safe-haven assets they were for decades. Investors have found alternatives in gold, the Japanese yen, the Swiss franc, and German government bonds. This shift is one of the key drivers behind the 7% decline in the USD index since the start of the year. How long could this trend last?

In my opinion, Trump's policy is fundamentally flawed. In trying to reduce the U.S. current account deficit, he is cutting off the export revenues of other countries—revenues that were historically reinvested into the U.S. via securities purchases. As a result, foreign investors have accumulated $19 trillion in U.S. equities and $7 trillion in Treasuries. They also hold 20–30% of the U.S. corporate bond market. These assets are now being dumped, fueling the upward trend in EUR/USD.

Technically, the daily chart of the EUR/USD pair shows a pullback as speculators take profit on long positions. A rebound from support levels at the pivot point (1.1425) and fair value (1.1380) should be seen as an opportunity to build new long positions on EUR/USD.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.